Announcing KP 20 & KP Select II

This is a special year for Kleiner Perkins – we’re celebrating 50 years of partnering with incredible founders who’ve made history. Today, we’re excited to announce our twentieth venture fund, KP 20, an $800m fund to back early stage companies and our second select fund, KP Select II, a $1 billion fund to back high inflection investments. With these two new funds we are excited to start backing the next 50 years of history-making founders.

Over the past five decades we have been the earliest backers for over 1,000 companies, including the likes of Google, Amazon and Genentech. These companies have altered the course of humankind and improved our lives. They have created 1.5+ million jobs and generated $4.5 trillion in enterprise value. Along the way we have returned over $35 billion to our limited partners, who multiply their impact by deploying returns for initiatives like funding vaccine research, and providing thousands of scholarships to brilliant young minds who would’ve missed the opportunity to attend college otherwise.

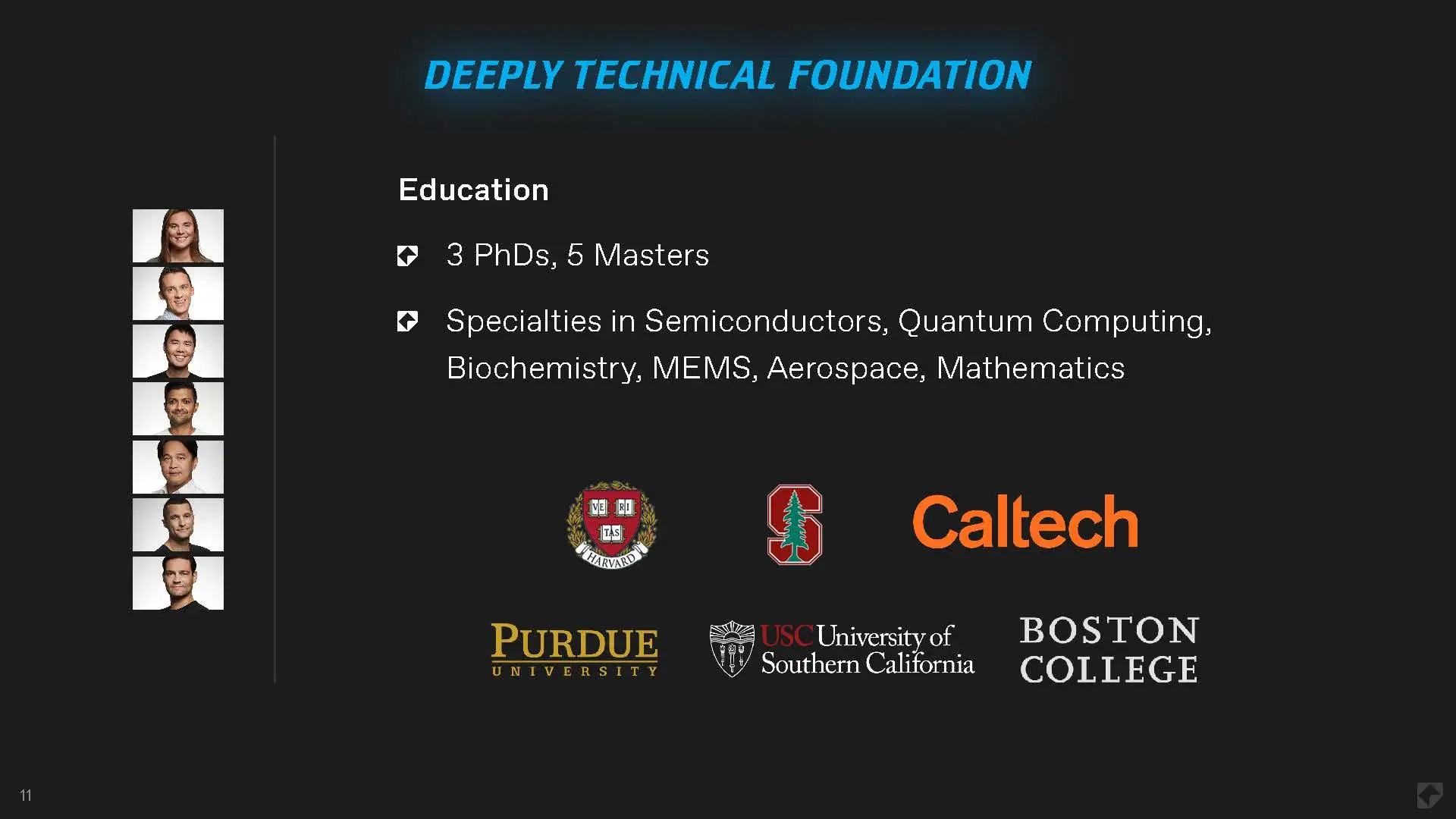

As a firm, we have evolved tremendously. Over the last four years, we first went back to our roots of early stage investing and company building, and then expanded our funds to support founders as they hit inflection and escape velocity. The most important part of our evolution has been our team – our next generation.

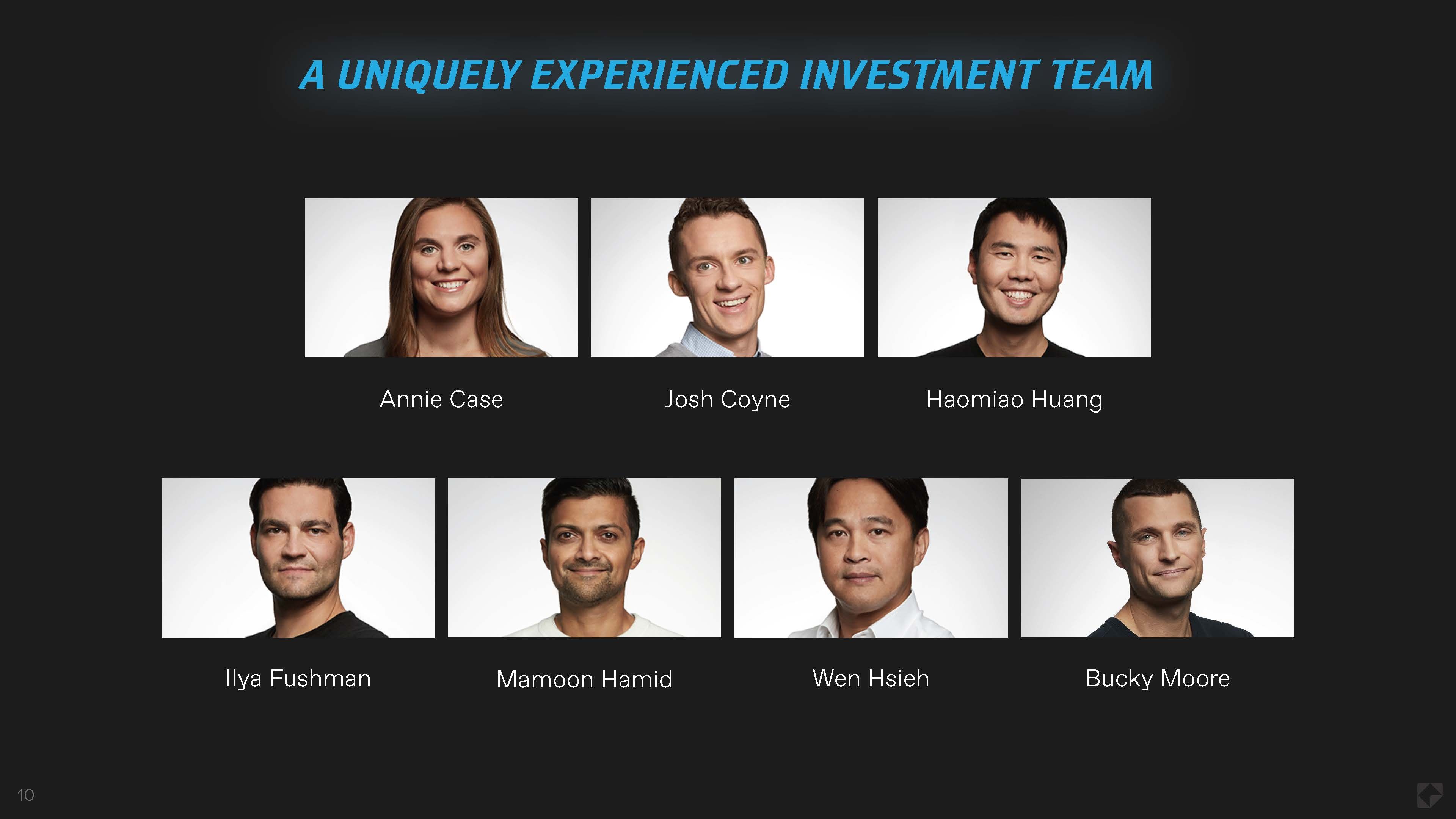

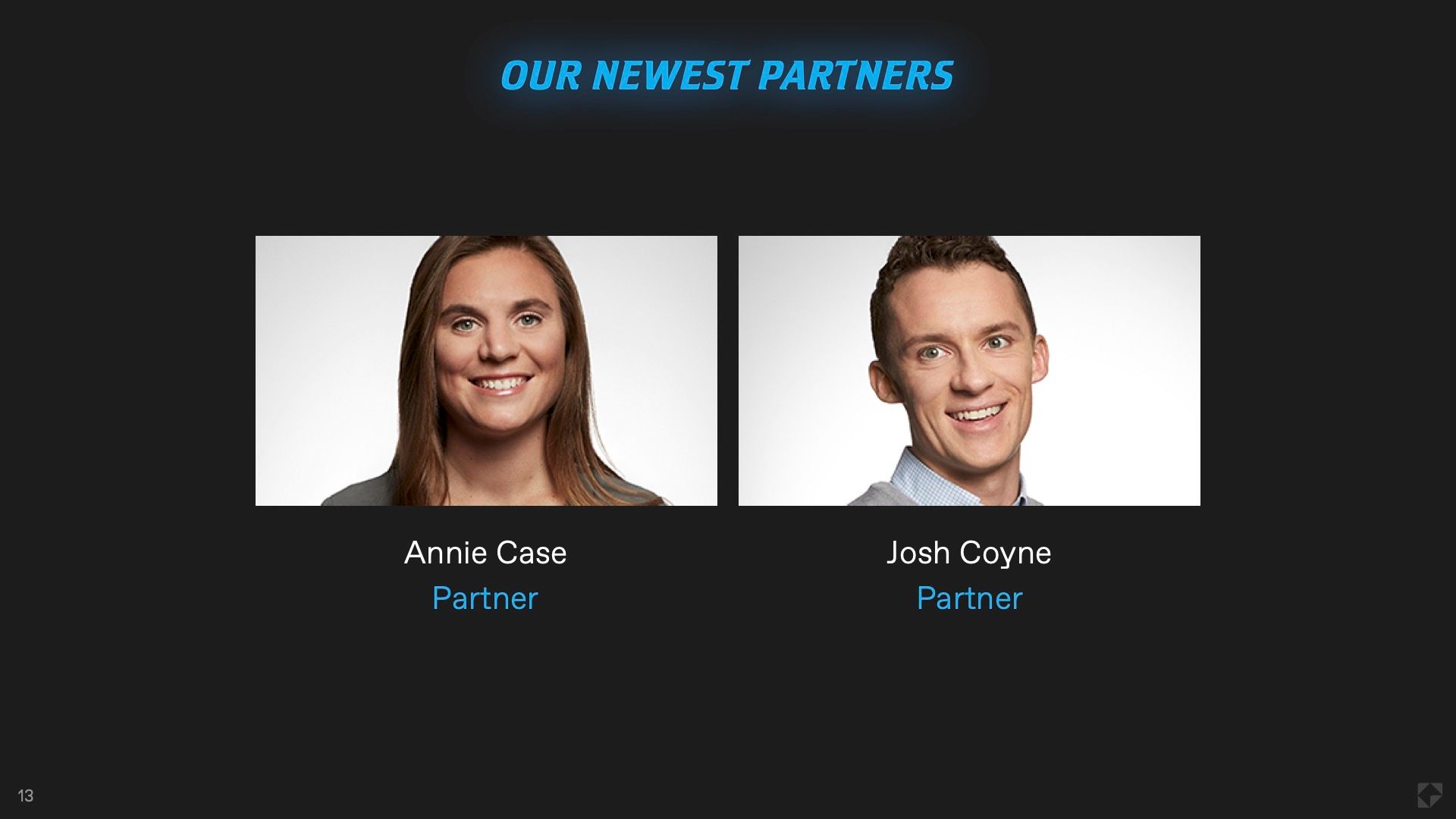

With KP 20 and KP Select II, we are excited to announce the promotions of Annie Case and Josh Coyne to partner:

- Annie joined us in 2018 as an investor and has become widely recognized as an expert on consumer technology and digital health, and we look forward to her continuing to lead investments in those areas. She serves on the boards of Emile, Future, Inkitt, MedArrive, Modern Health, and a few companies in stealth.

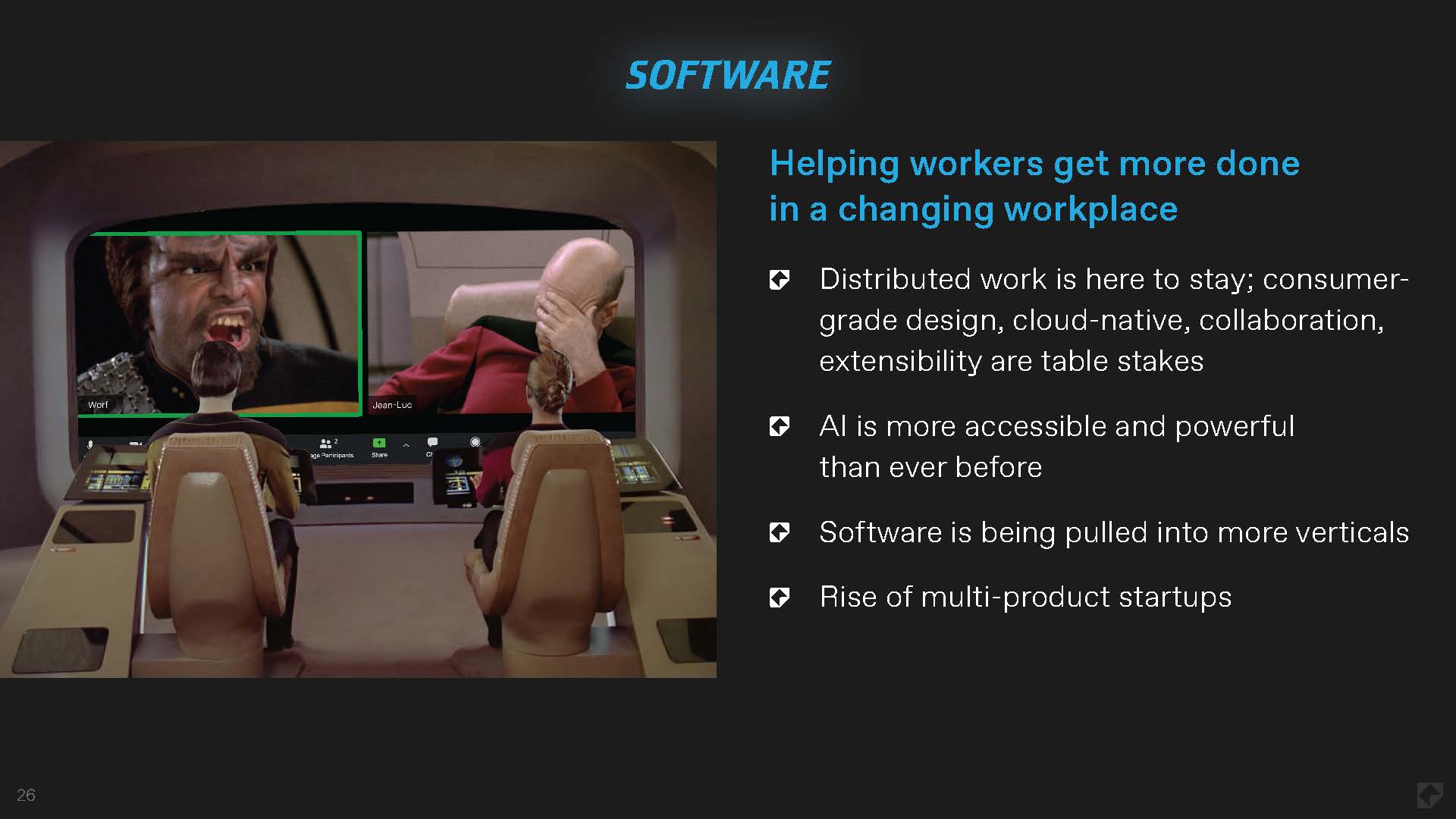

- Josh joined us in 2017 as an investor. He has a love for investing in software that helps automate or transform business processes that seem broken or antiquated with investments like Secureframe, Stord, Moveworks, and Synthesia. We look forward to him continuing to lead investments in business software.

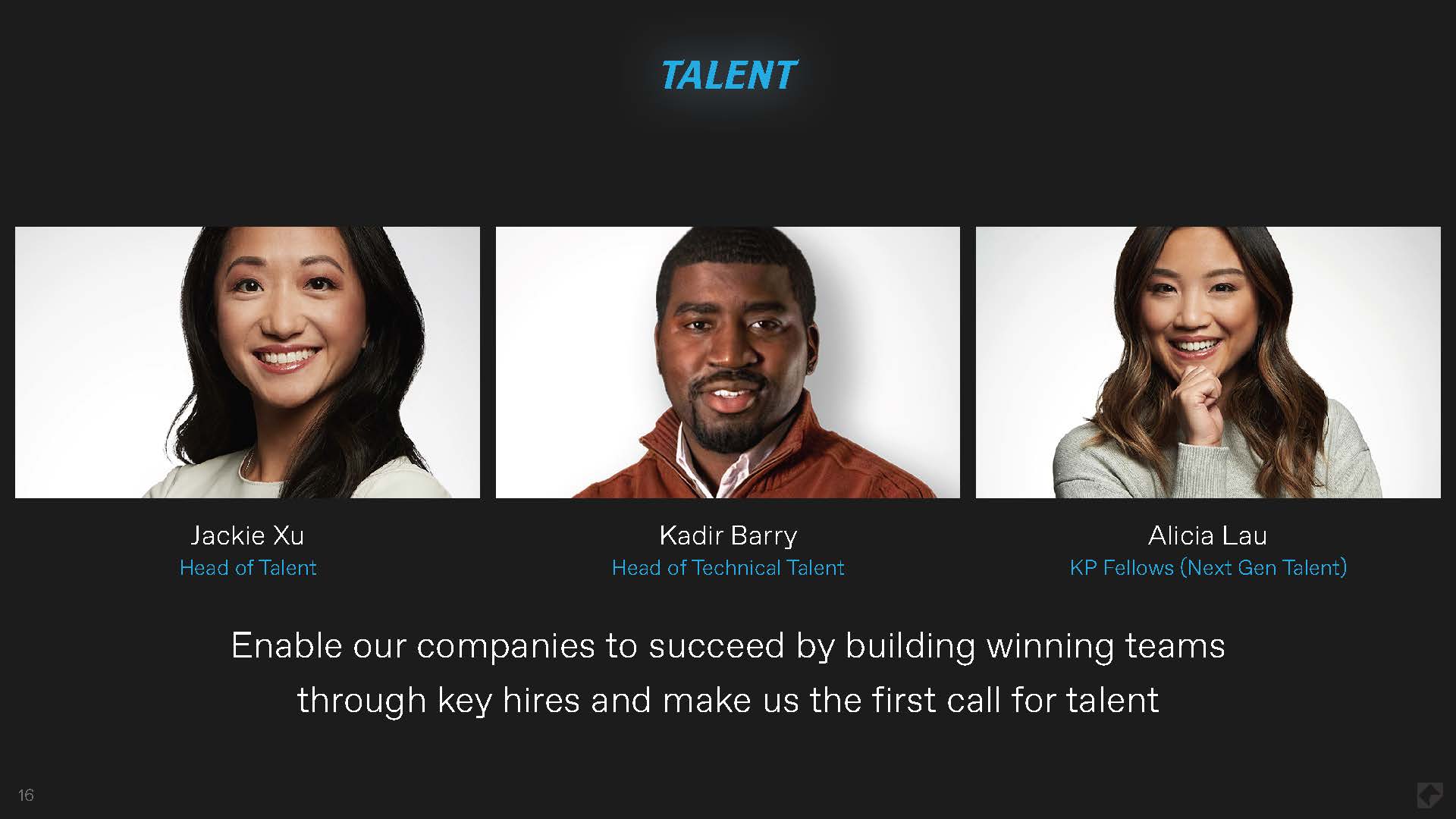

Investing is only one part of helping founders build history making companies. We are fortunate to have incredible talent, go-to-market, and marketing partners, and have expanded their teams to help our companies succeed.

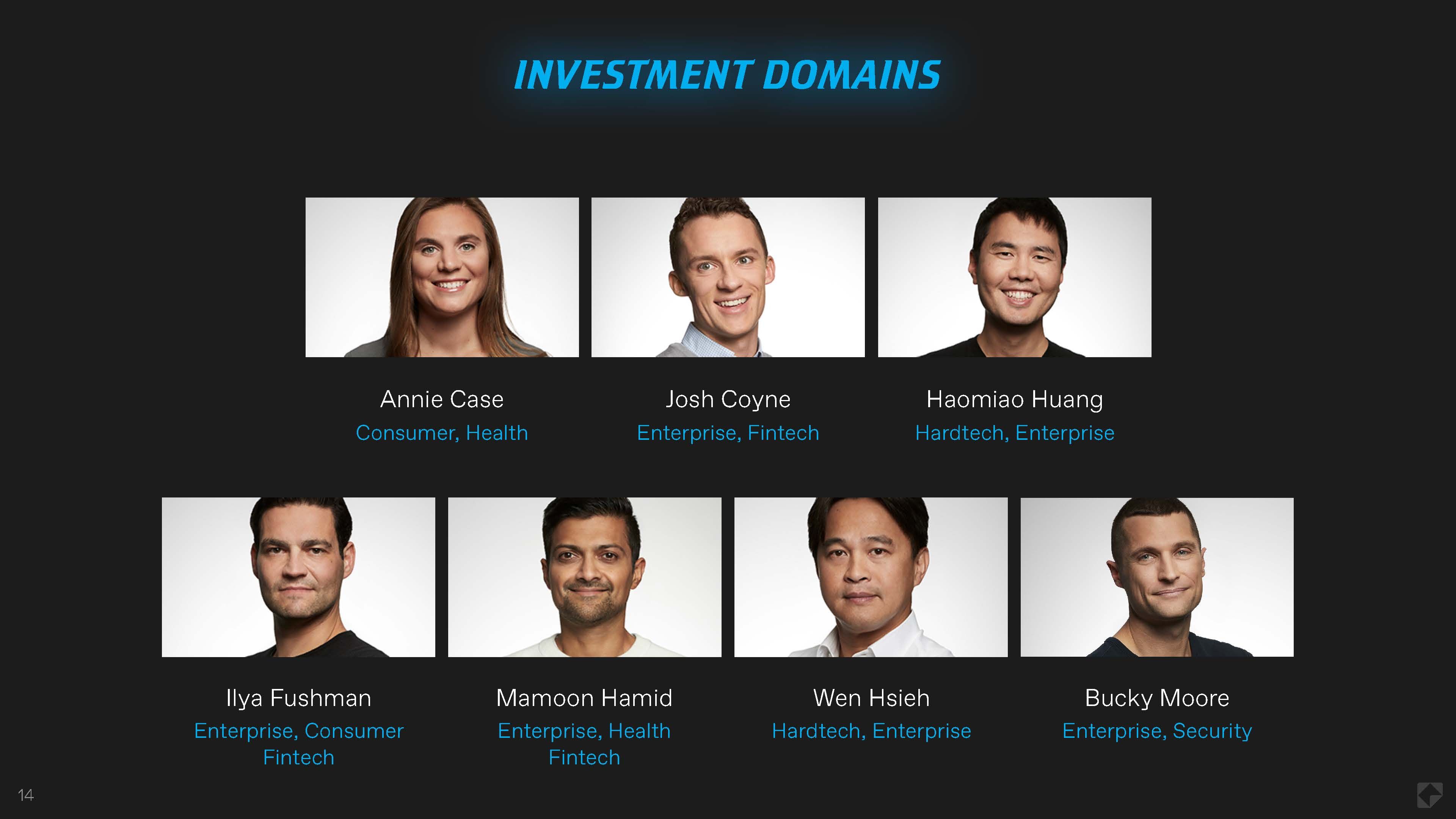

With these new funds and team, we will continue to invest in Consumer, Enterprise, Fintech, Digital Health and Hardtech companies and will increase our efforts when it comes to crypto and decentralized technologies.

We are deeply thankful to all the founders who have partnered with us on this journey. The way we live our lives and work will continue to evolve fundamentally and exponentially. The opportunities to create impact through technology are bigger than ever before, and happening faster than ever. We look forward to the next 50 years – for all of us to boldly go to a better future, and maybe even to space.