Announcing KP21 and Select III

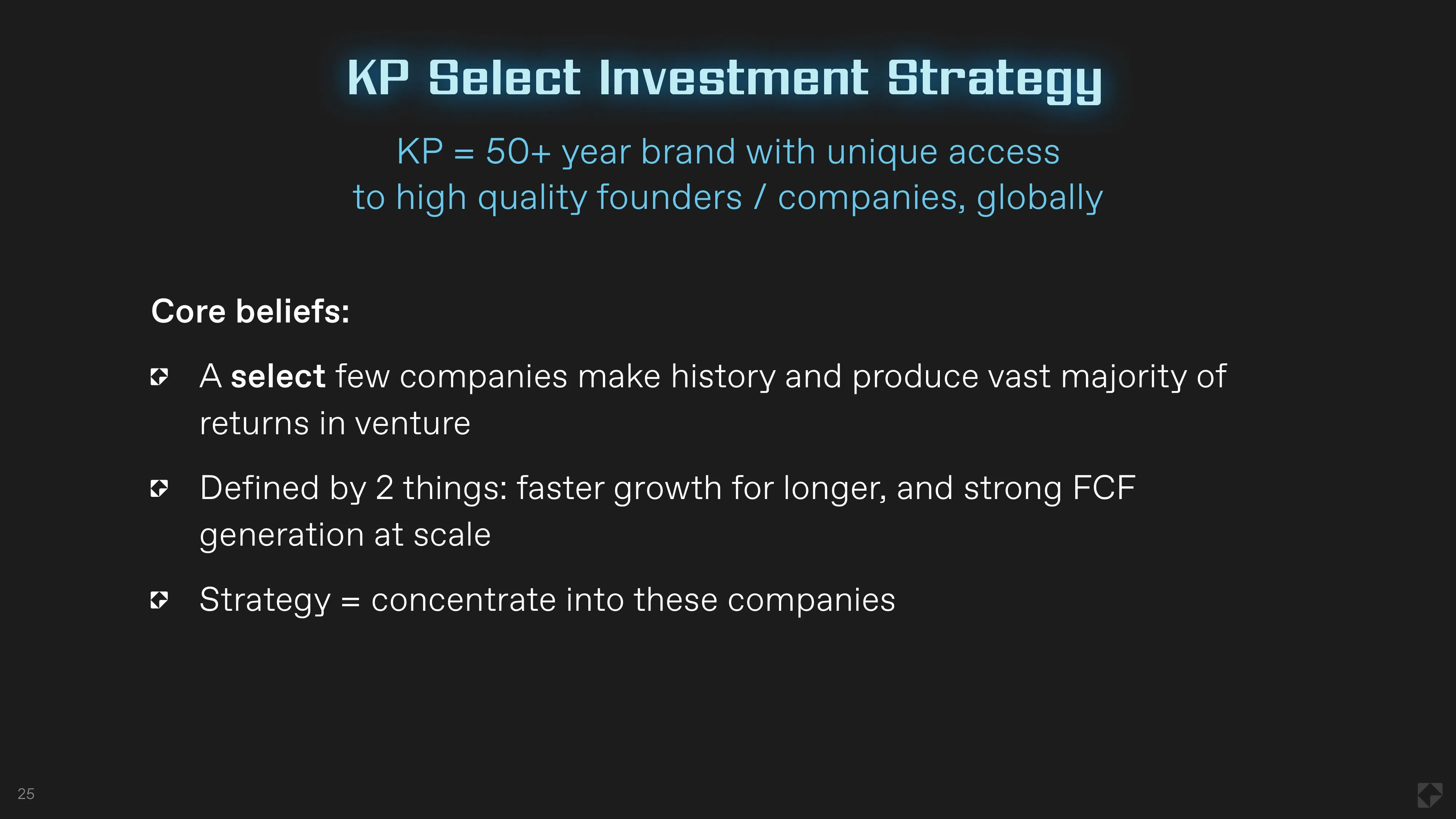

We are thrilled to announce our twenty first venture fund, KP21, an $825M fund to back early stage companies, and our third select fund, KP Select III, a $1.2 billion fund to back high inflection investments.

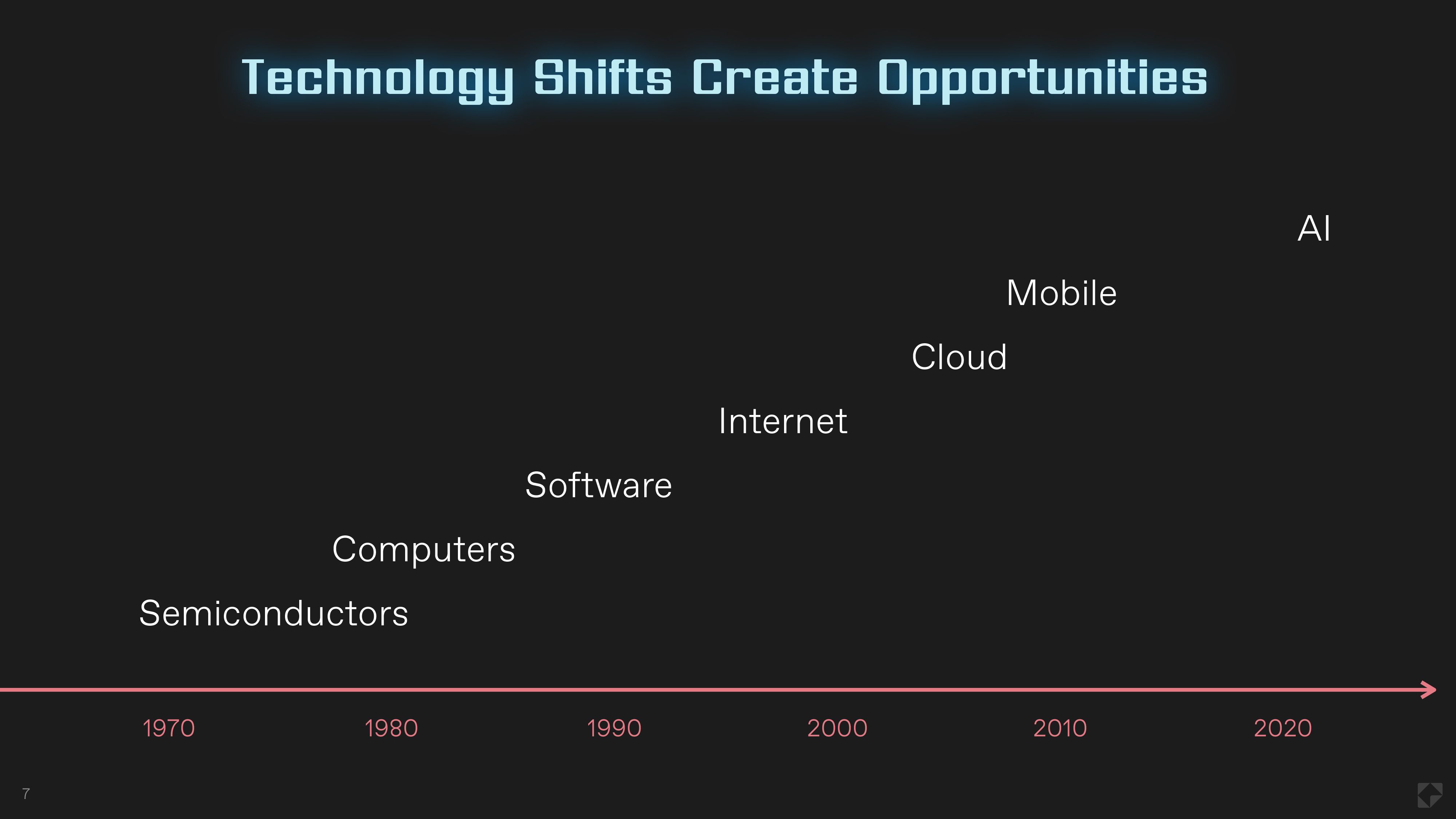

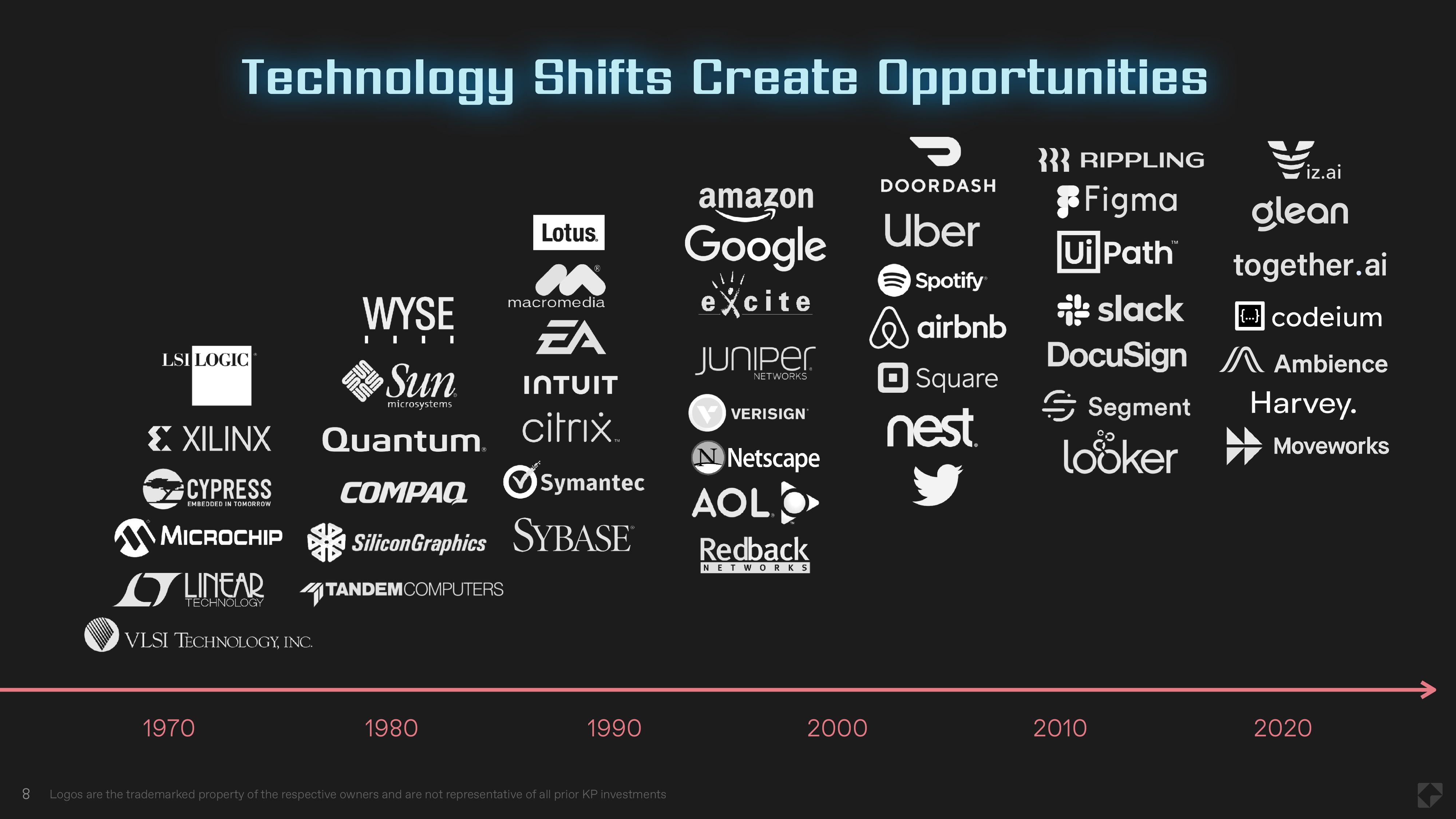

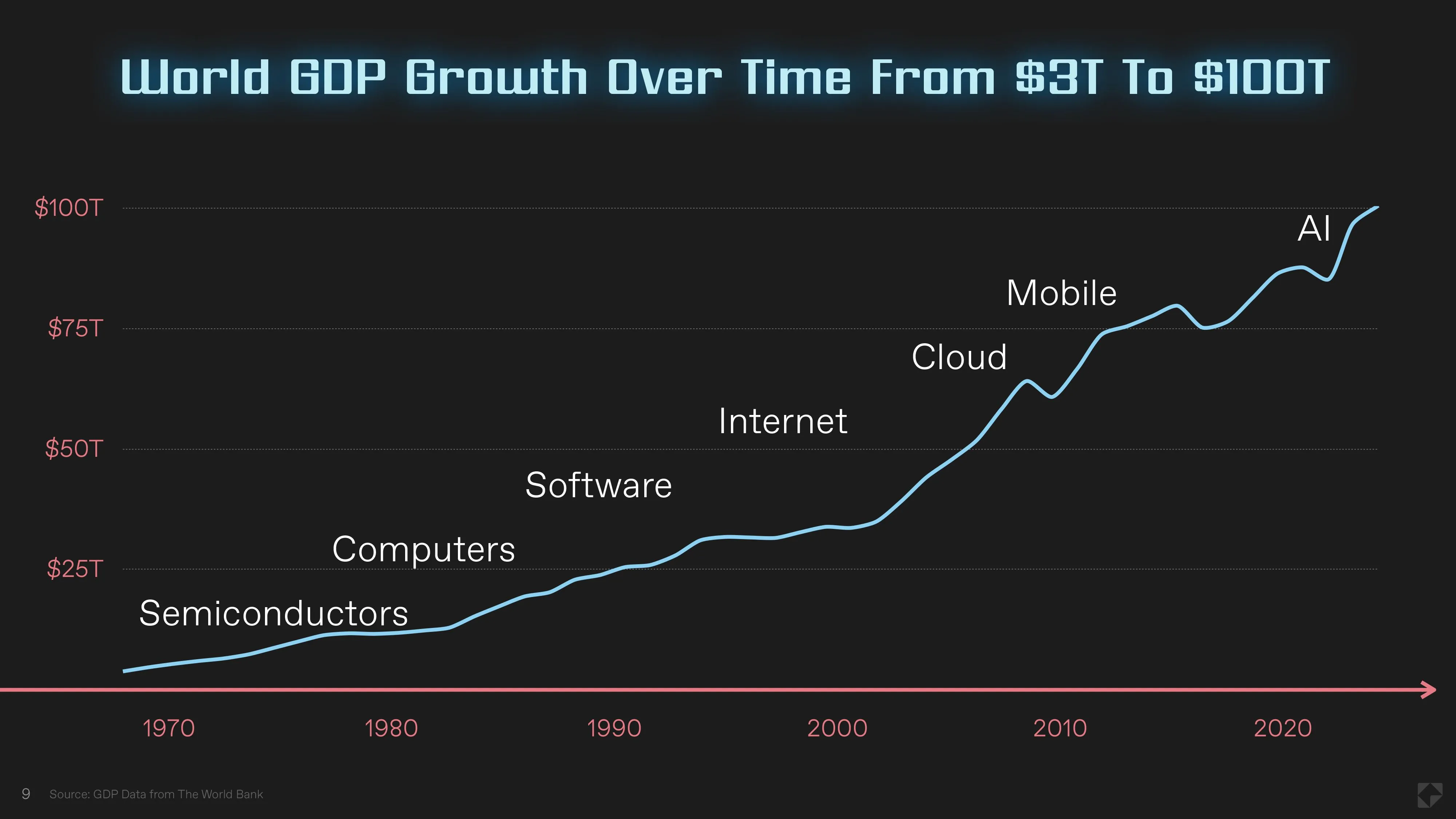

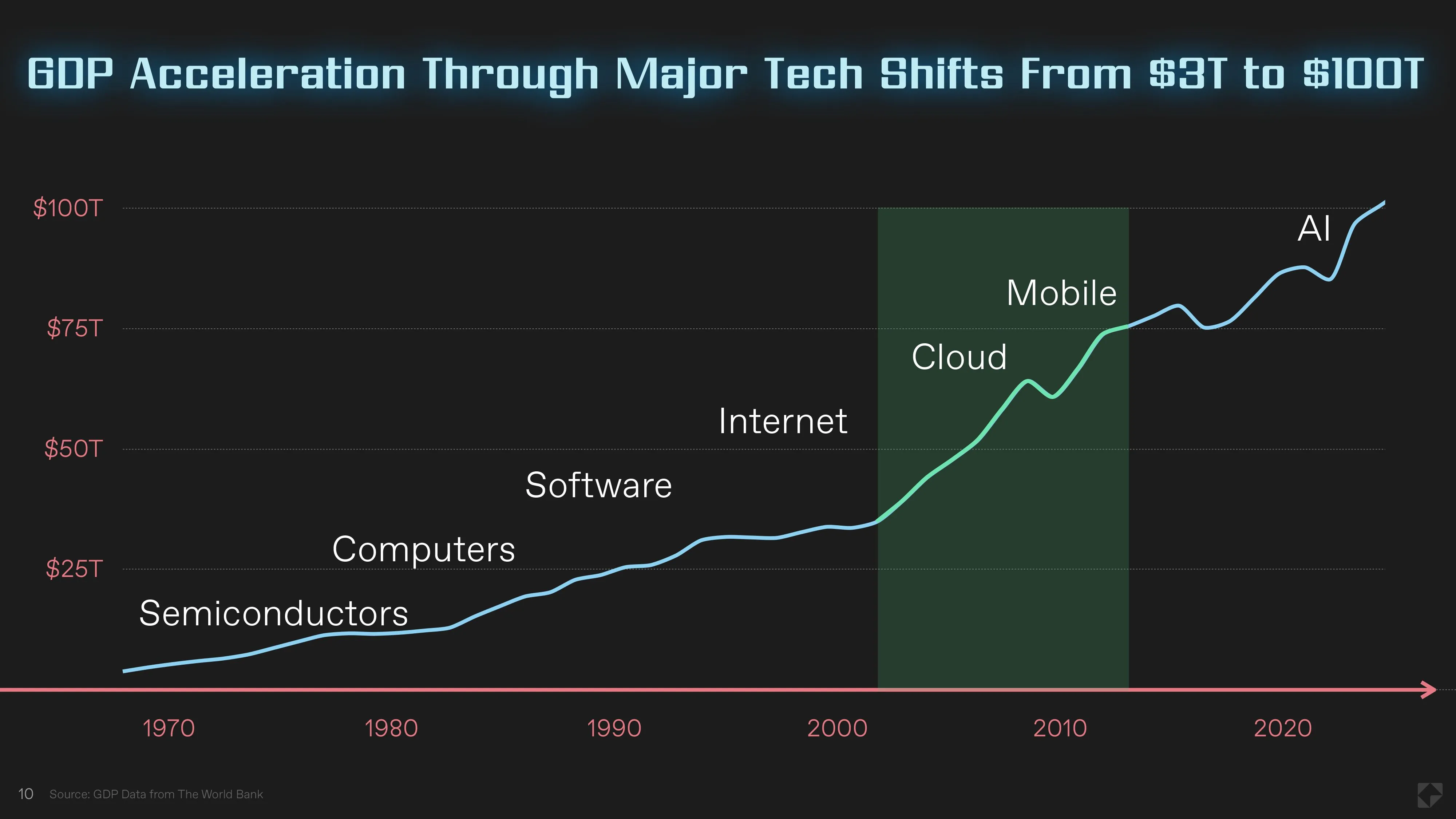

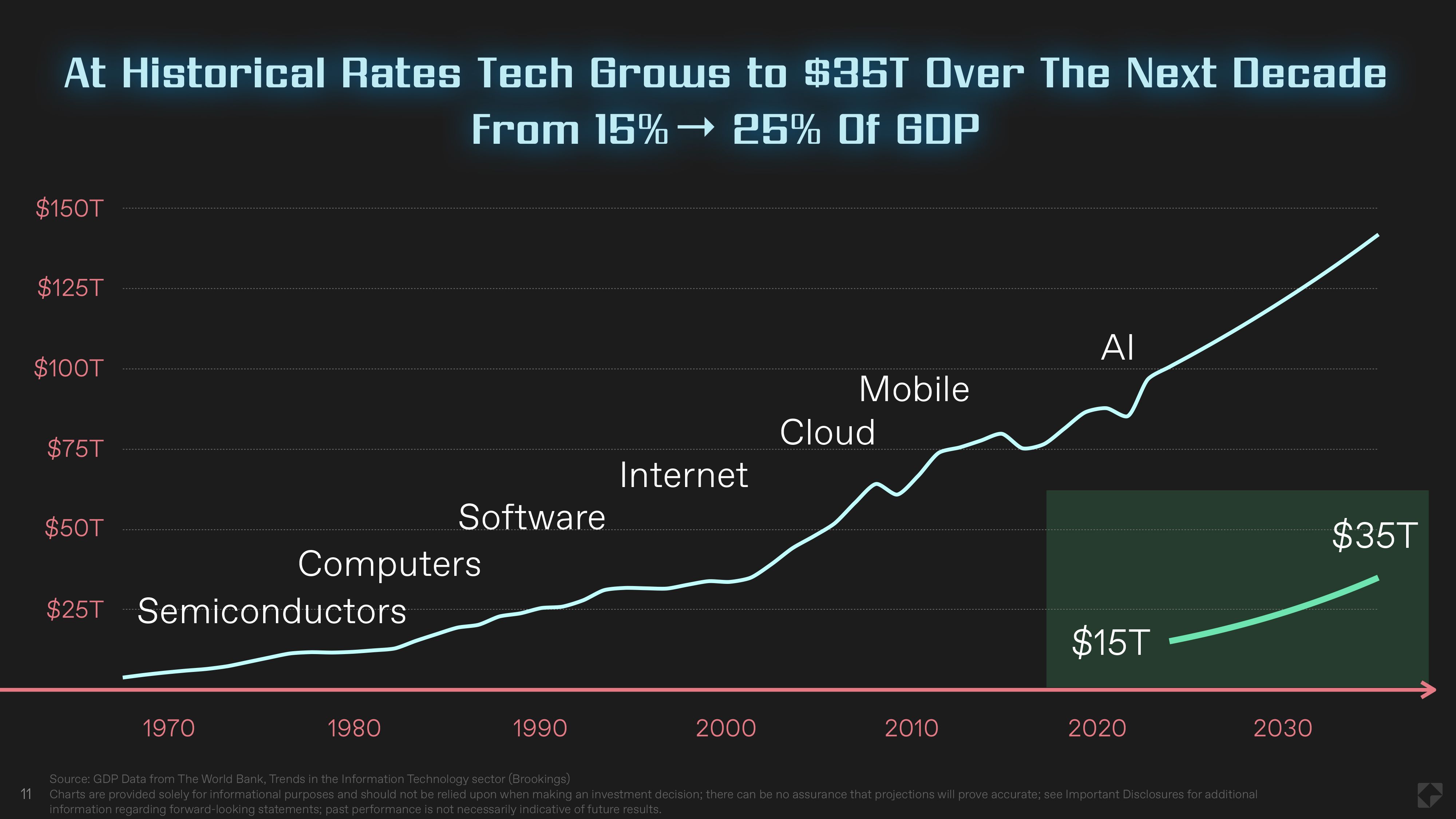

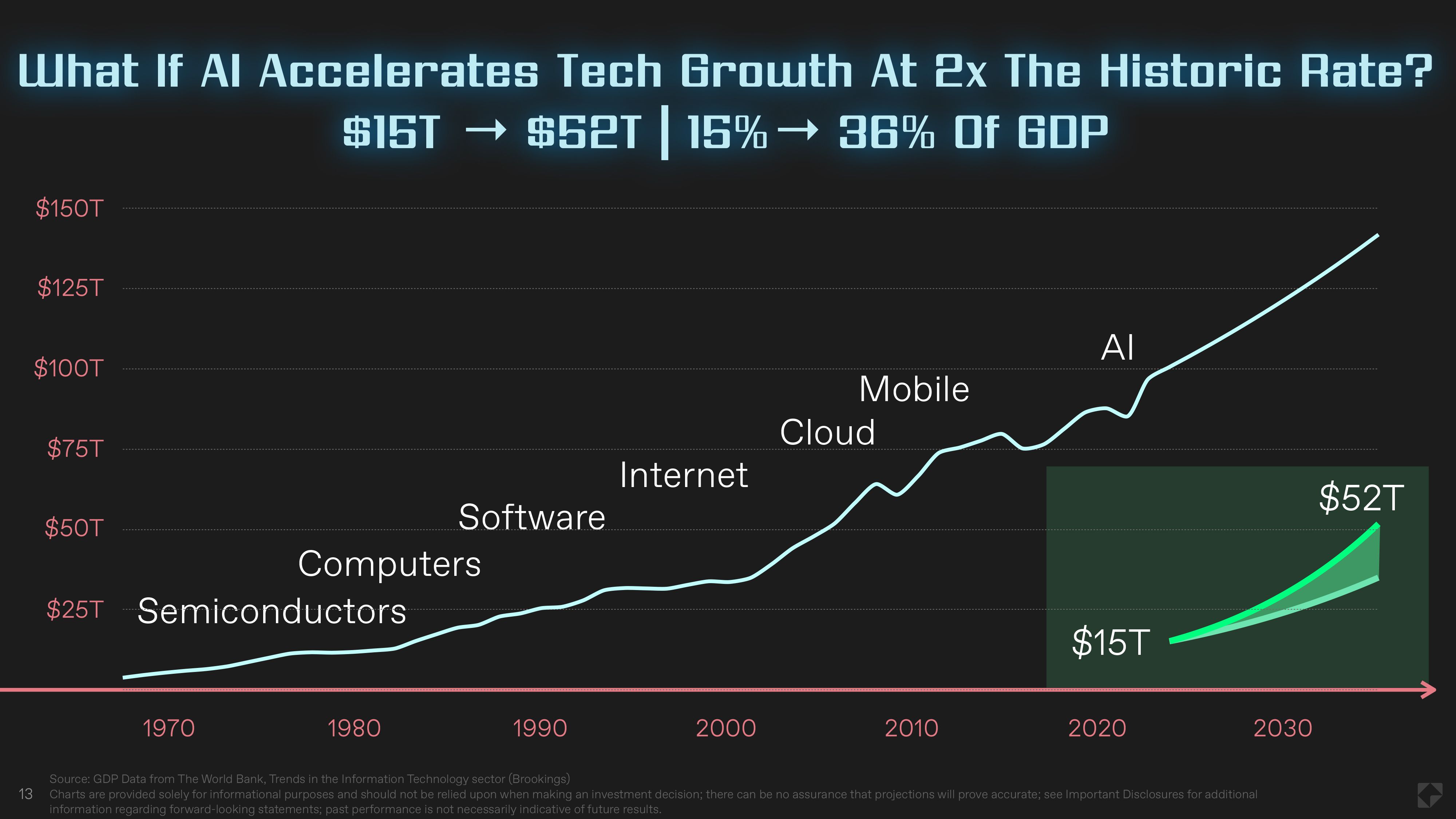

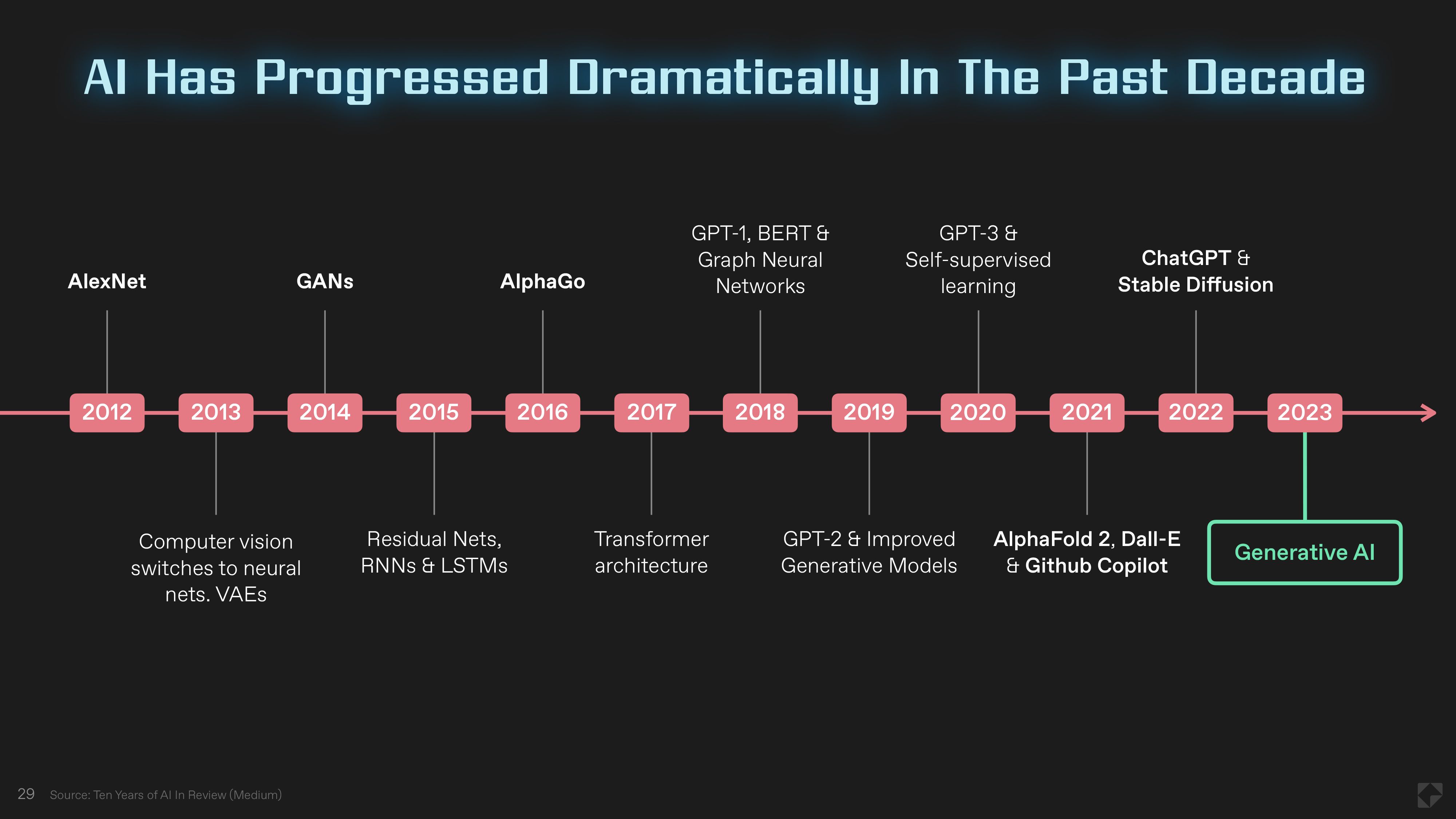

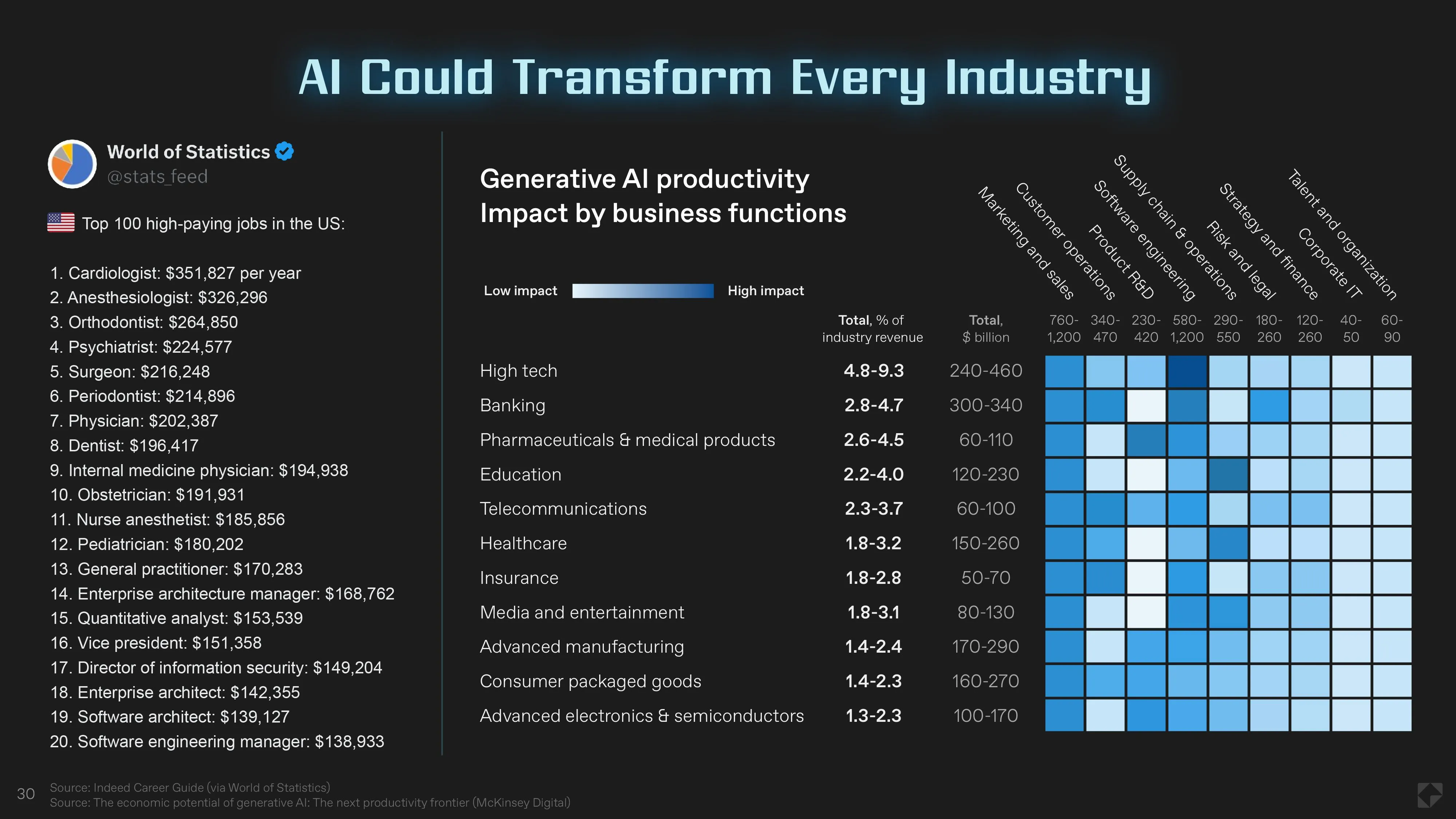

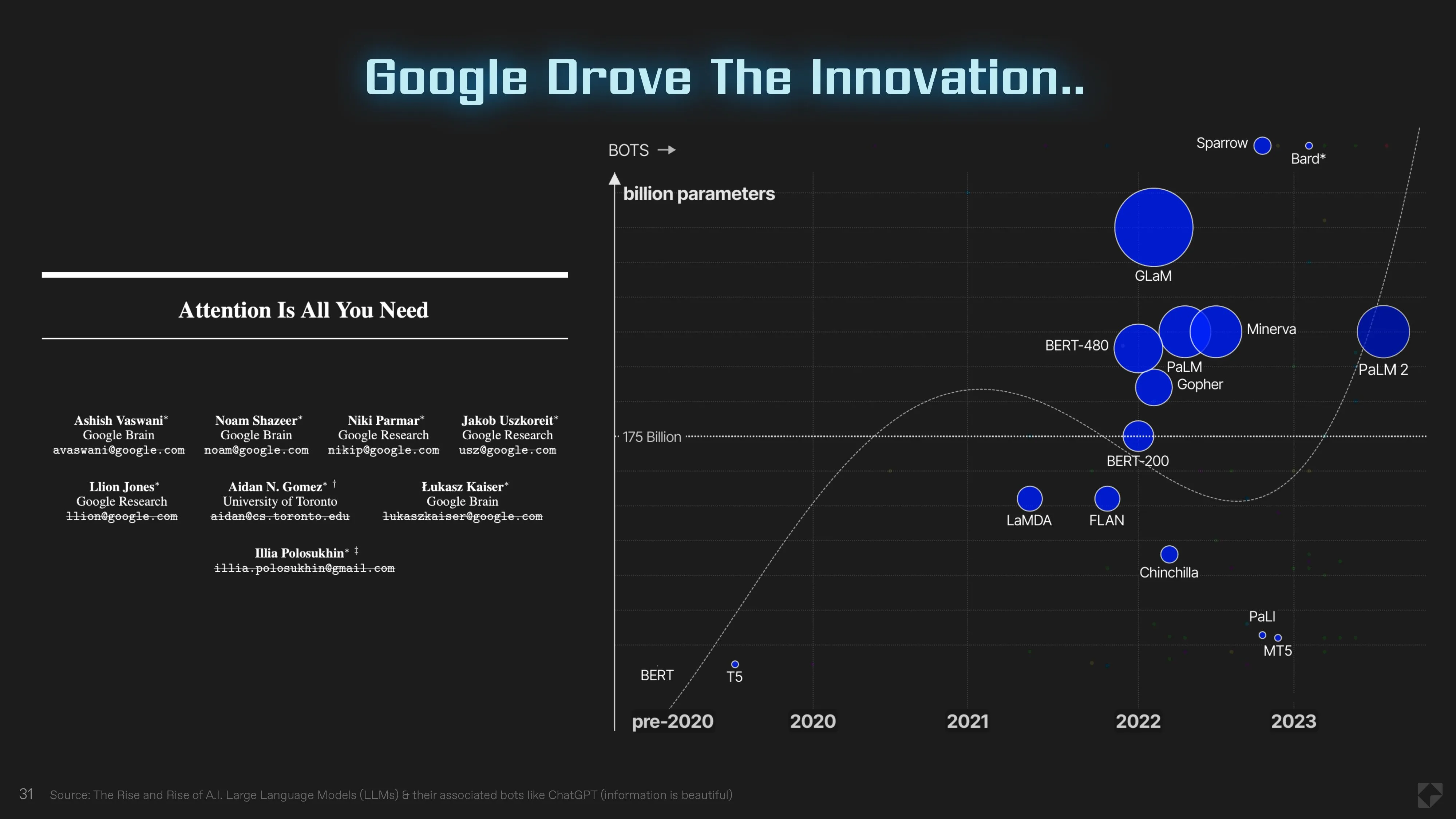

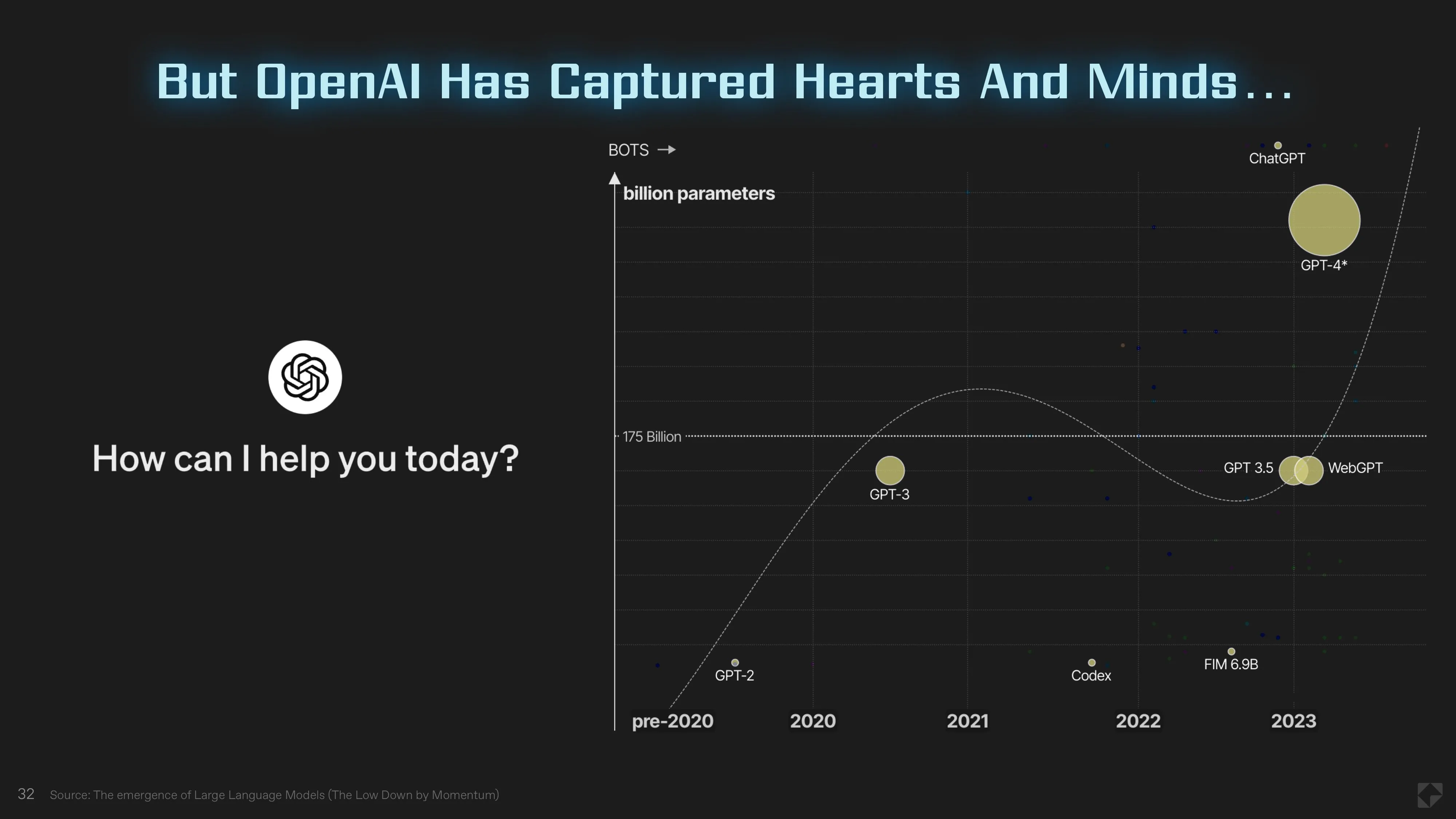

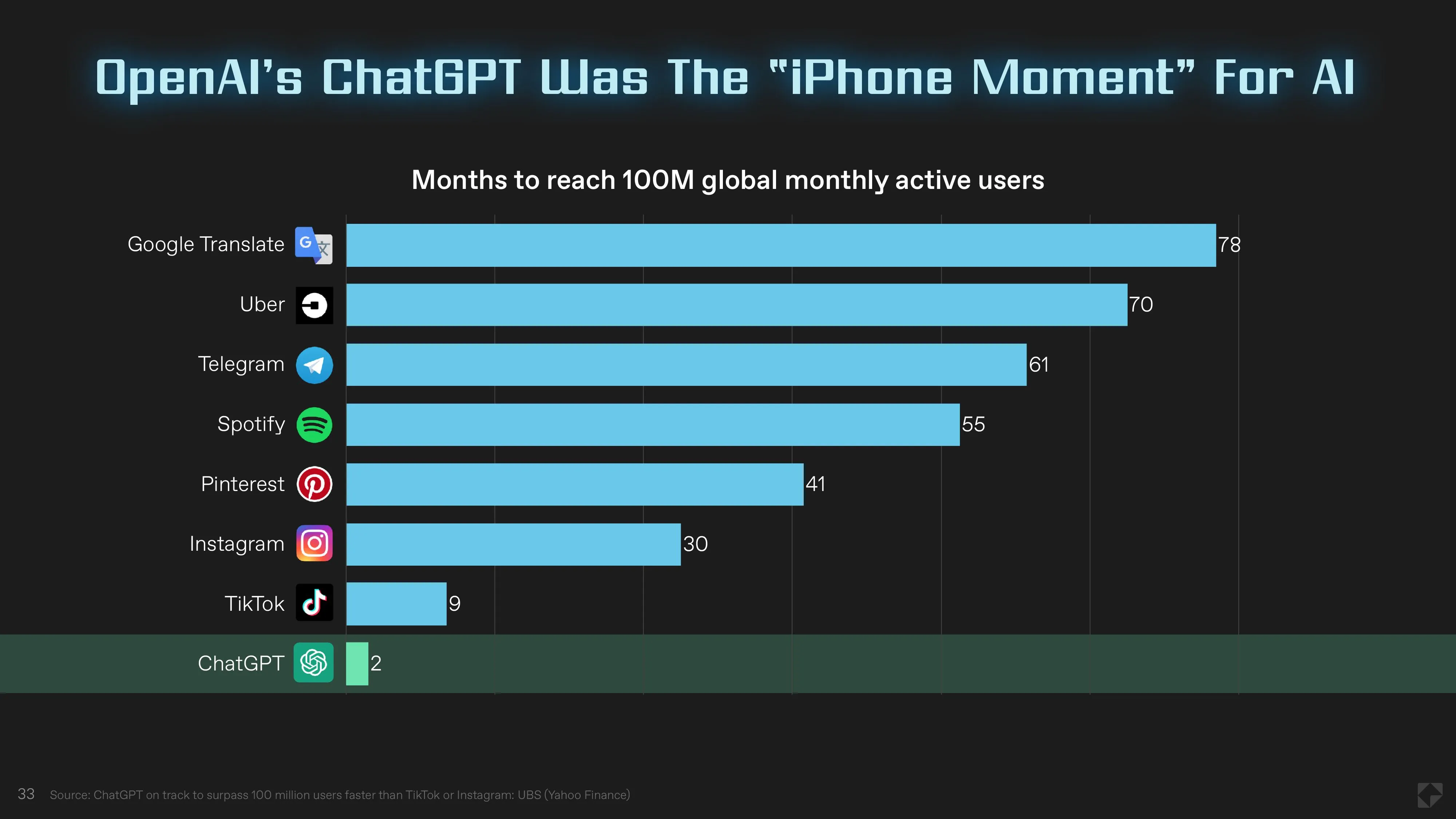

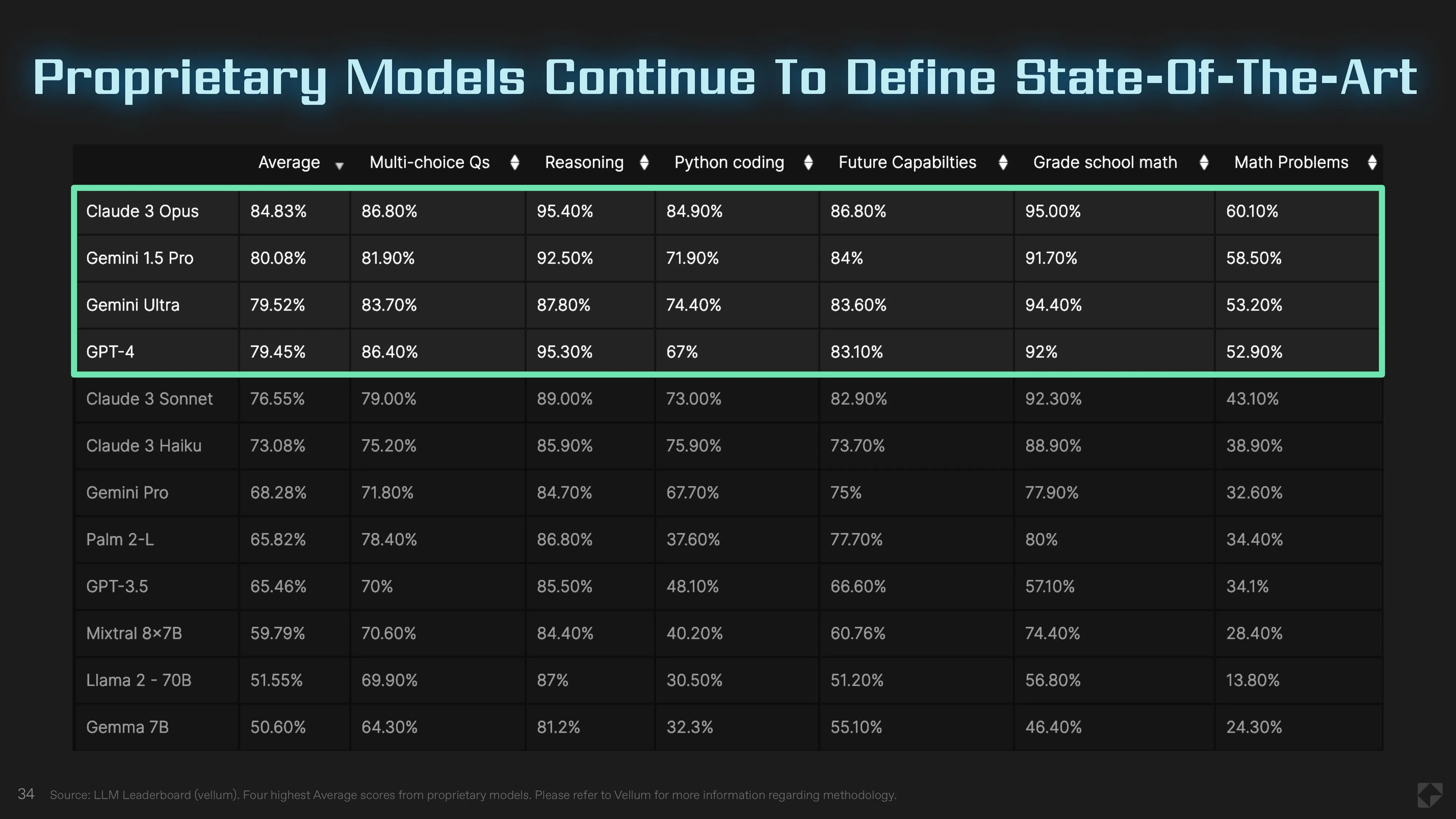

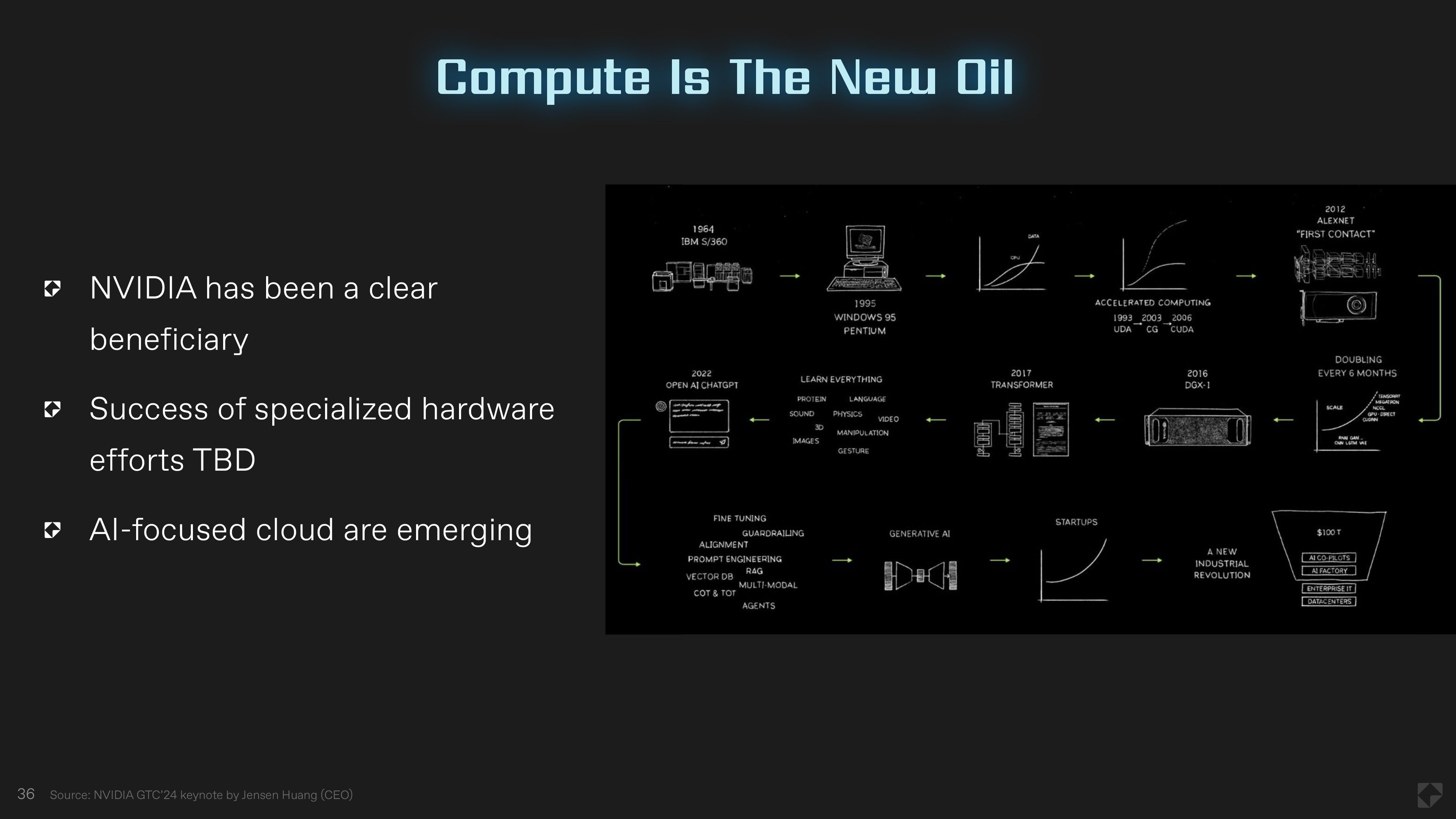

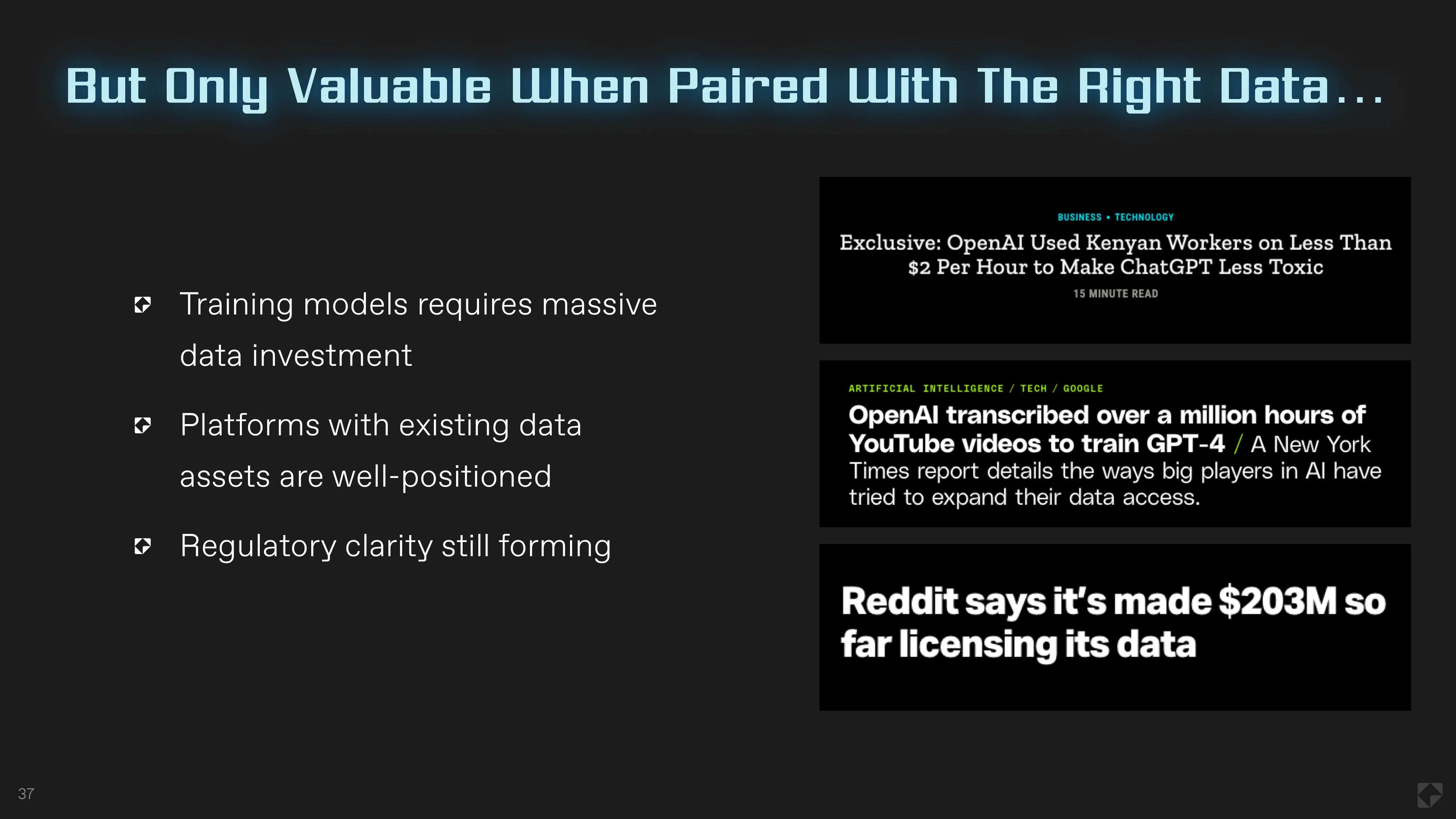

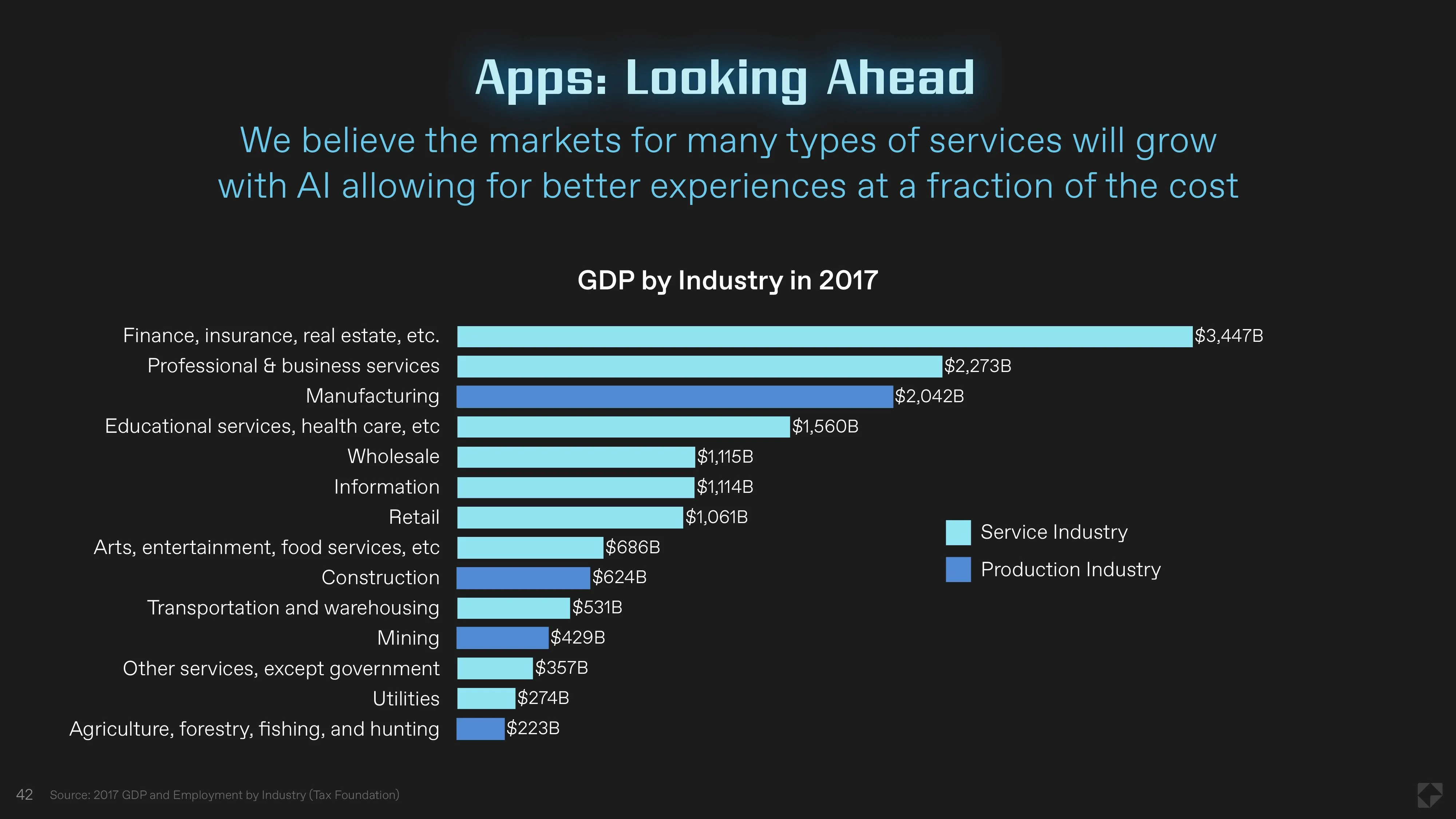

Since our last fundraise in 2022, the technology industry has evolved dramatically. Companies are achieving economic and societal impact and scale that’s never been imagined before. We believe that we are on the brink of remarkable technology shifts that will transform industries, amplify the power of human ingenuity, and generate significant economic growth. Artificial intelligence has emerged as a fundamental technology that’s catalyzing this transformation and, much like electricity, it’s poised to impact every aspect of our lives – from personal experiences and healthcare, to how we work and how companies are built across all industries.

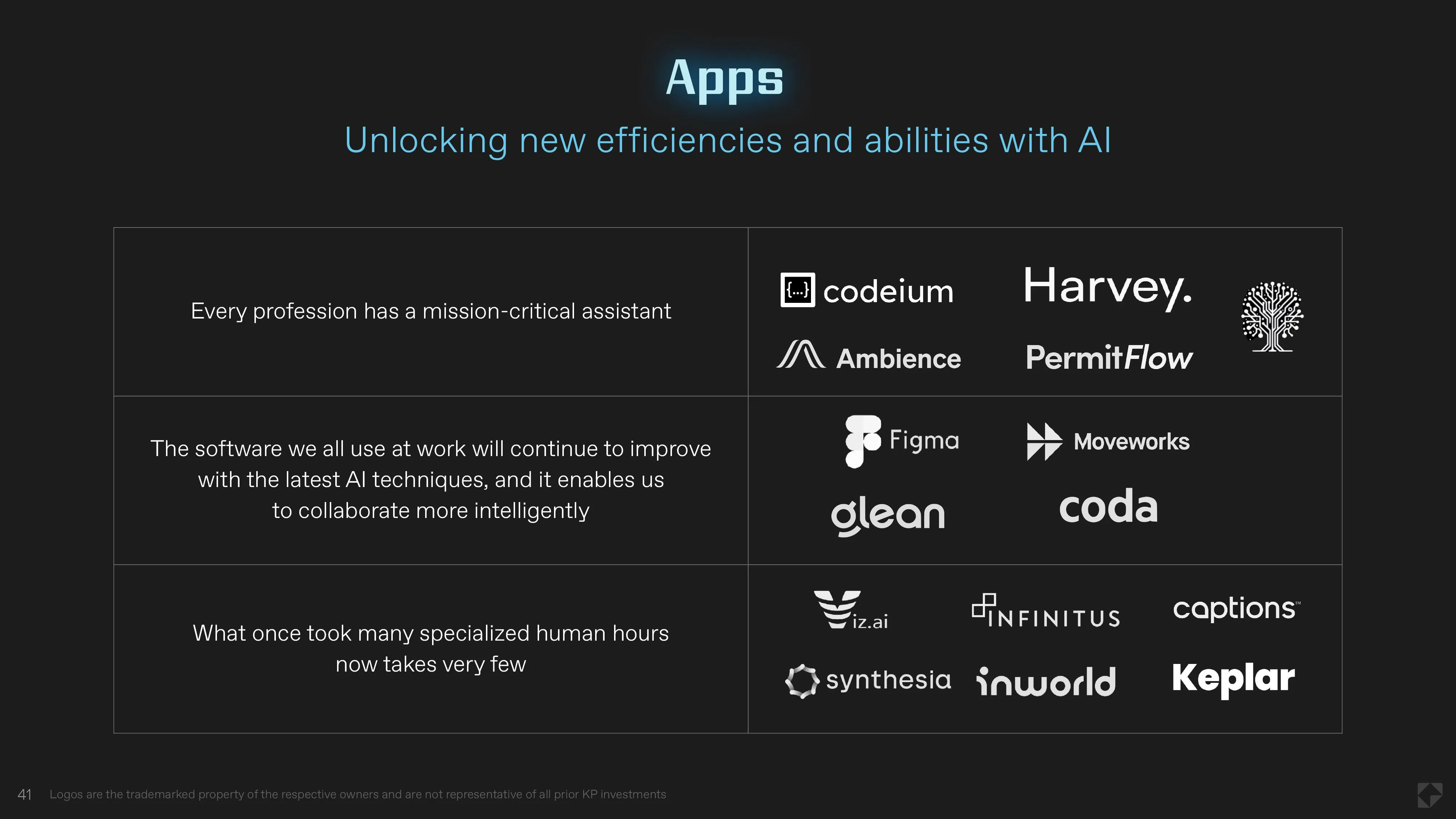

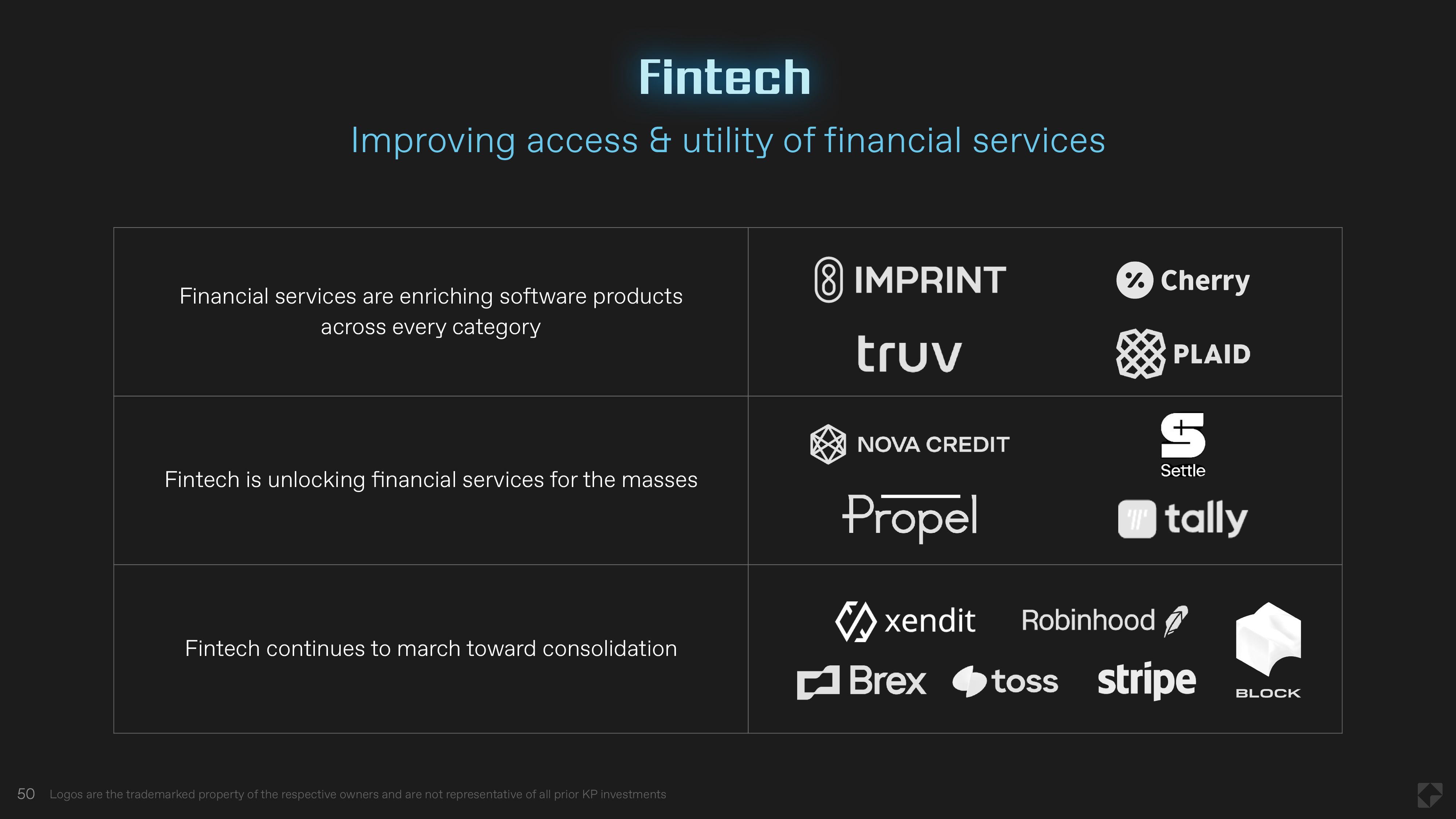

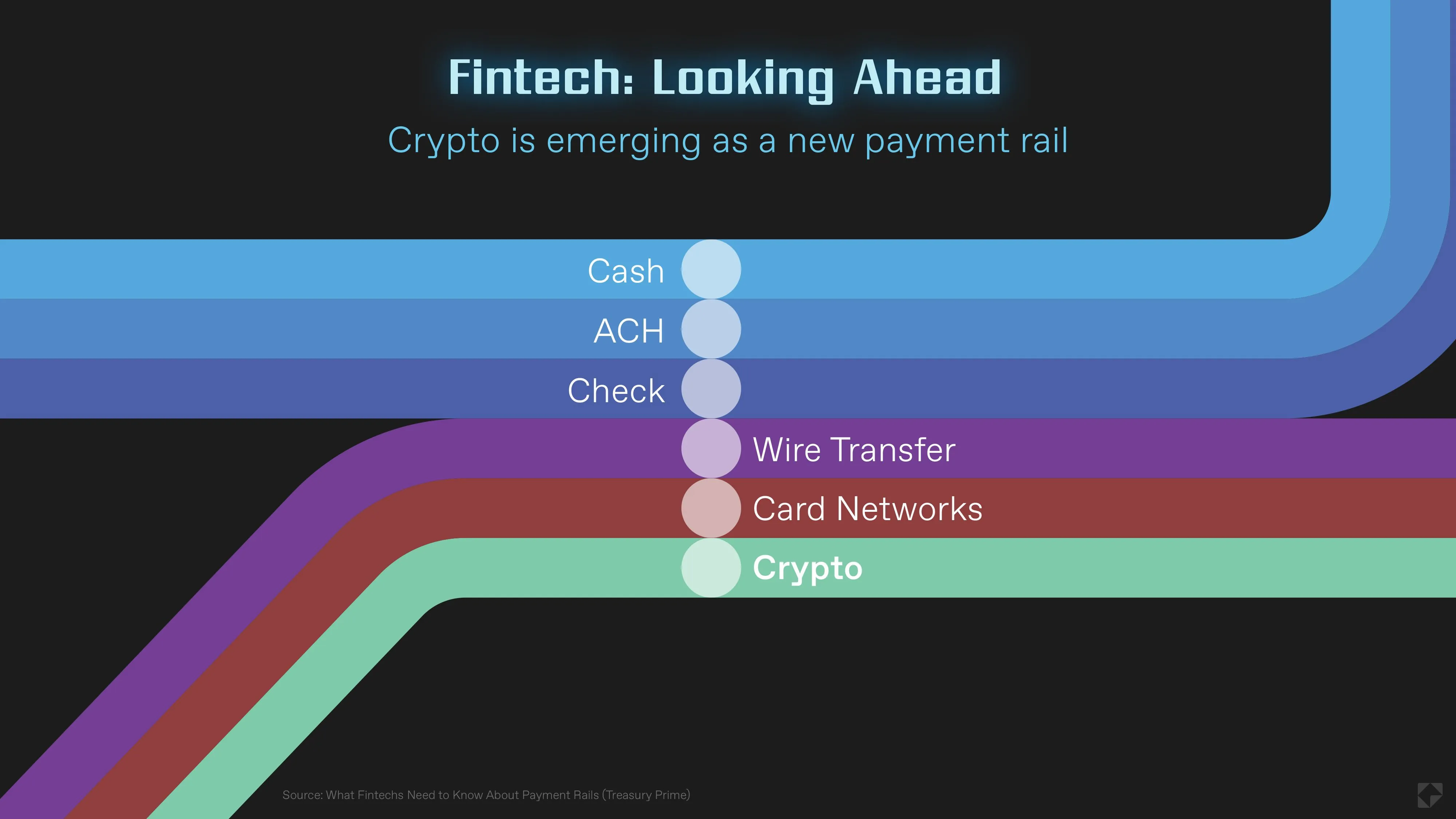

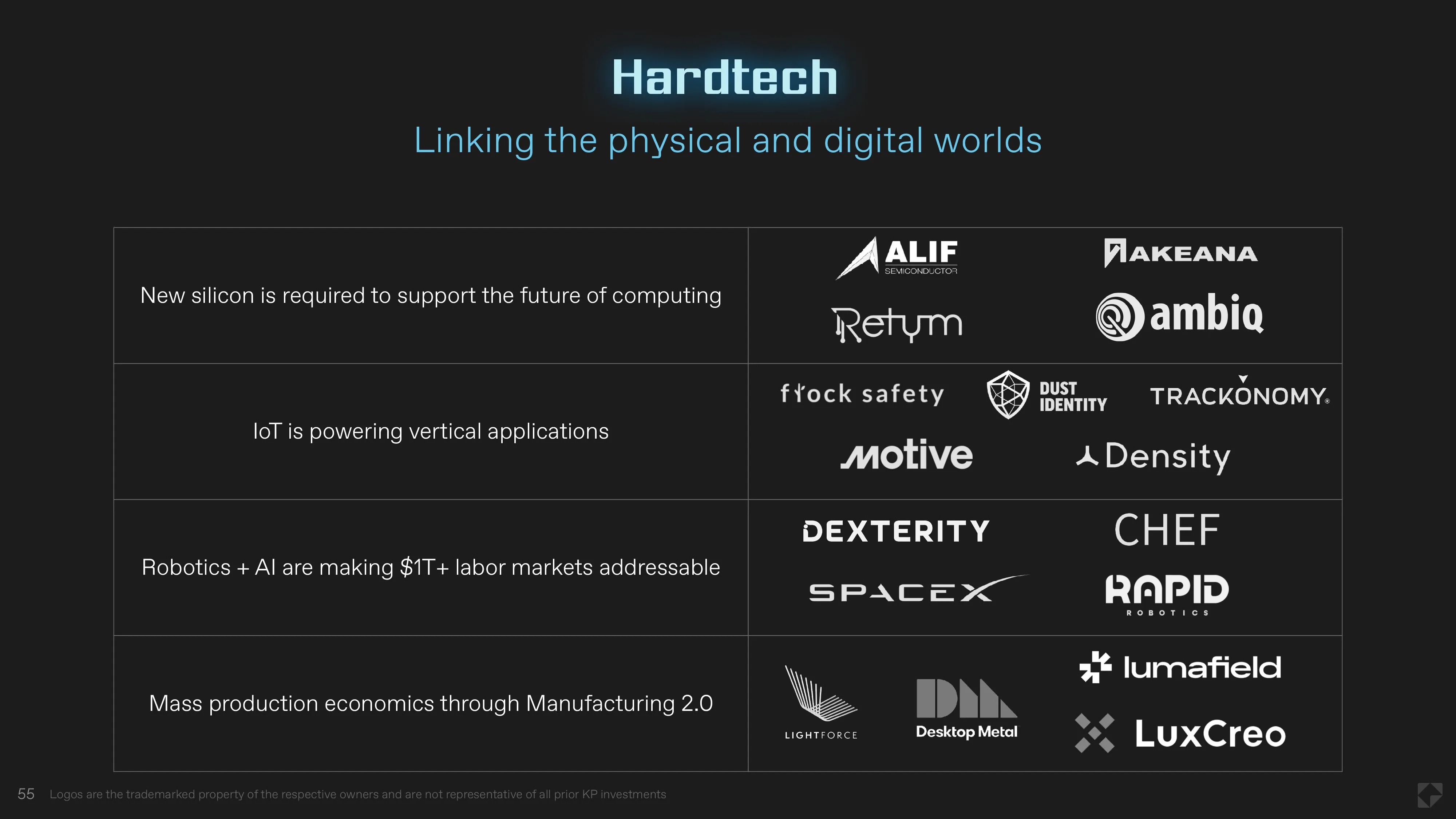

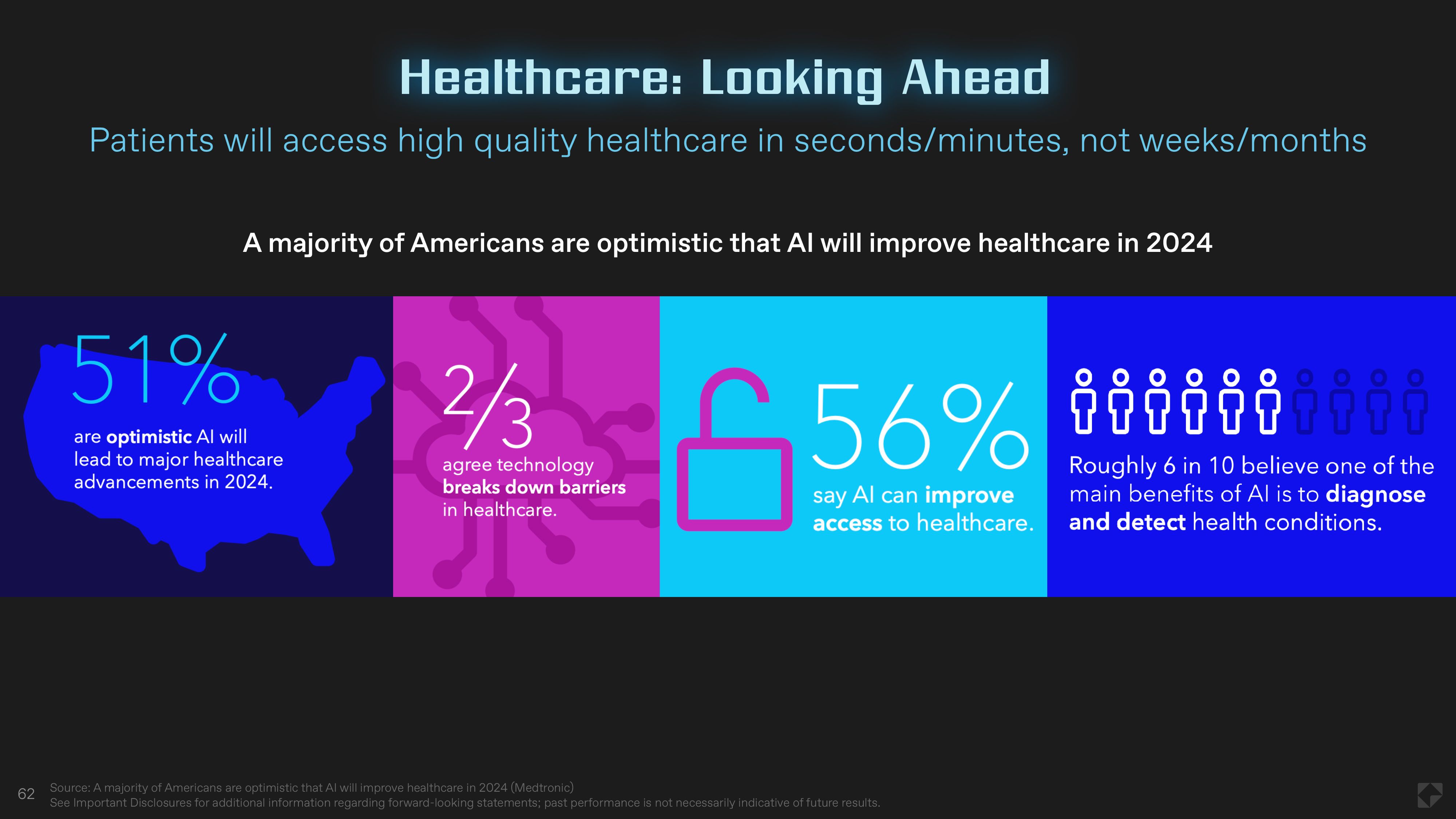

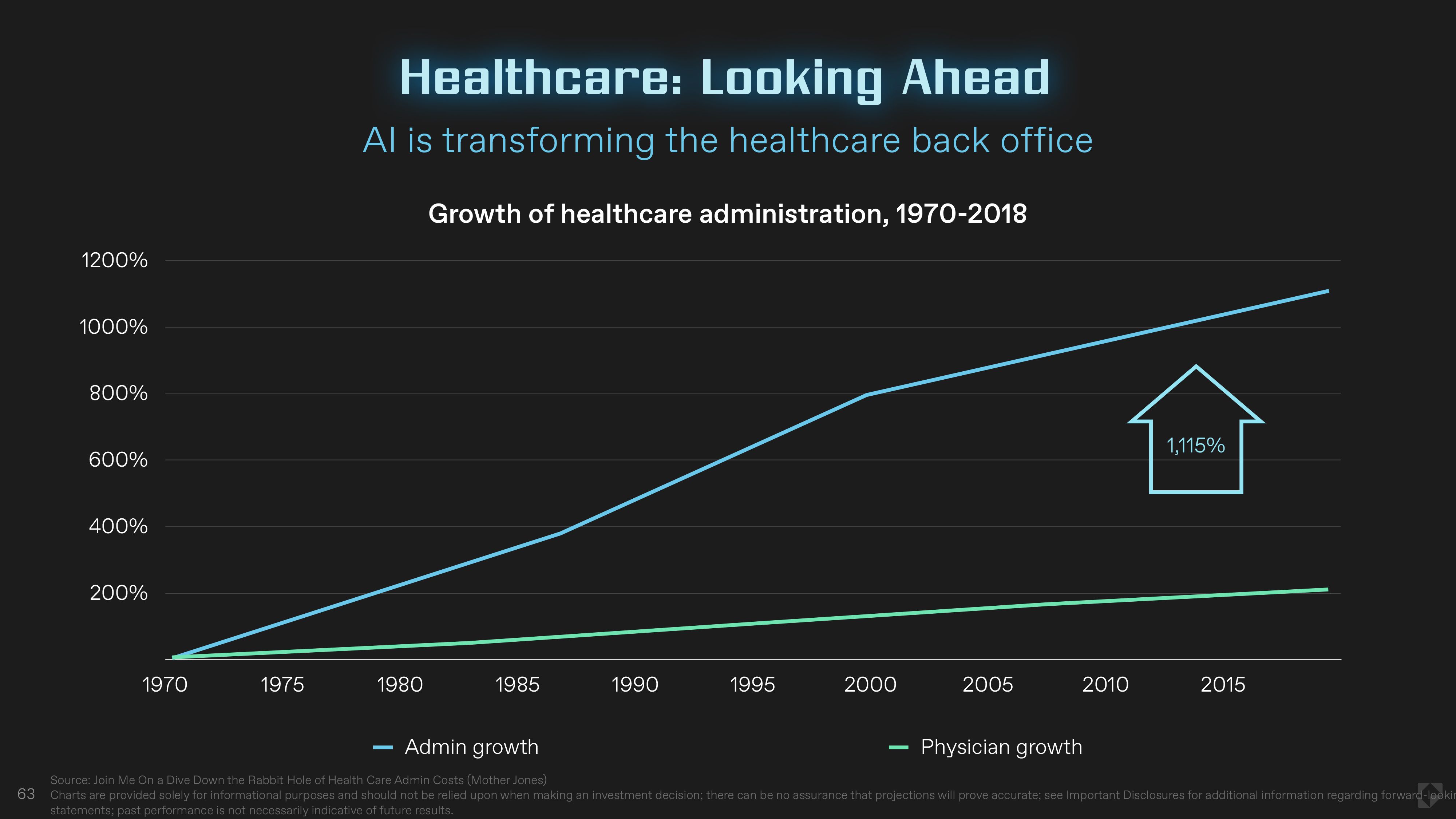

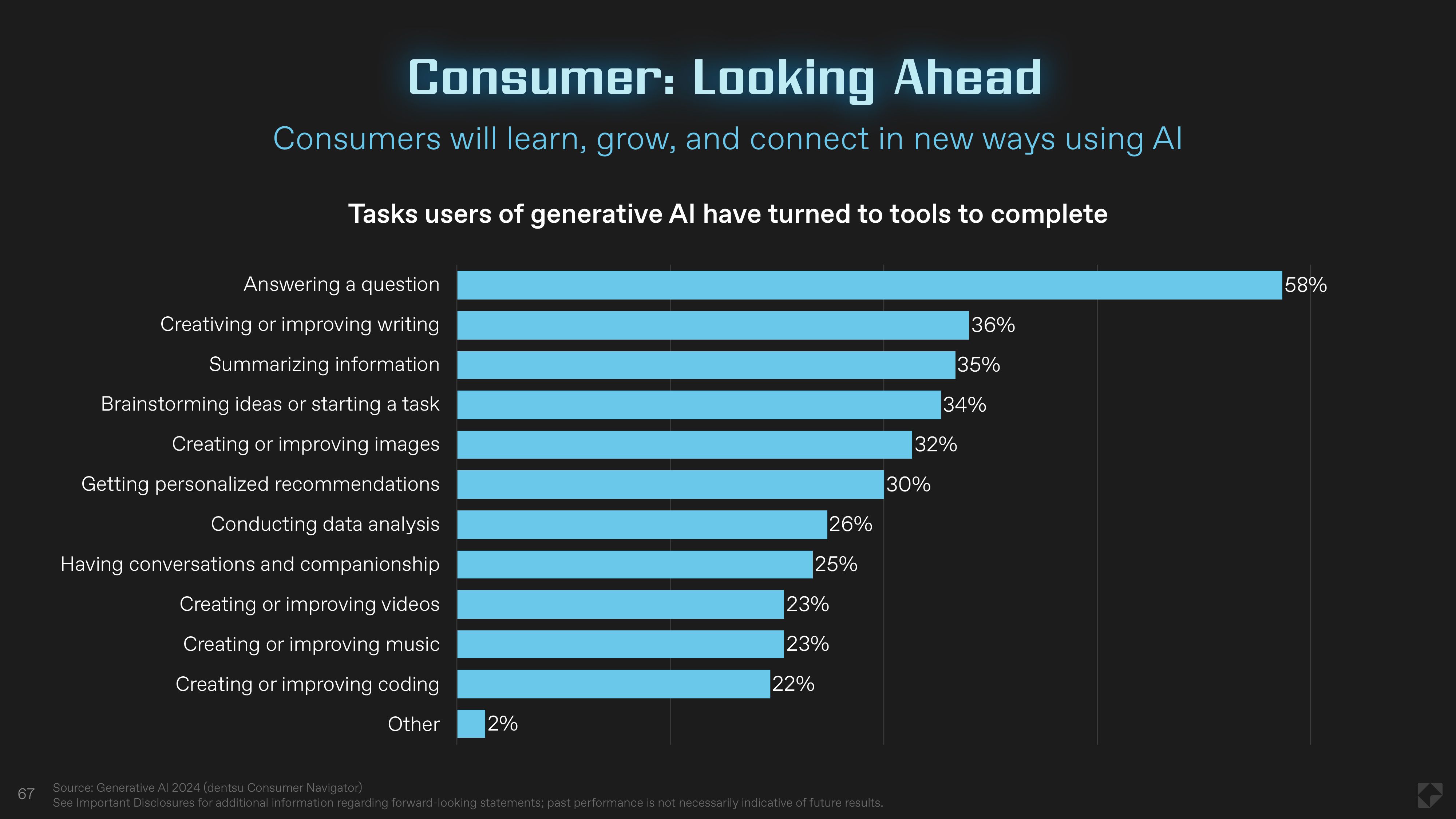

With these new funds, our team’s focus on enterprise software, consumer, healthcare, fintech and hardtech, remains the same. Each domain will be accelerated tremendously by AI. Repeated rote tasks are being quickly automated and offloaded to AI, so that humans can focus on what they do best – higher level reasoning and decision making. Human creativity will be complemented with machine intelligence and pave the way for novel consumer experiences. Industries that have been slower to adopt software, and that require human labor for low level work, like healthcare, legal, finance will see rapid transformation. New experiences and the demands of computation will open up opportunities in hardware and physical infrastructure. Imagination is now the constraining factor of the future of technology.

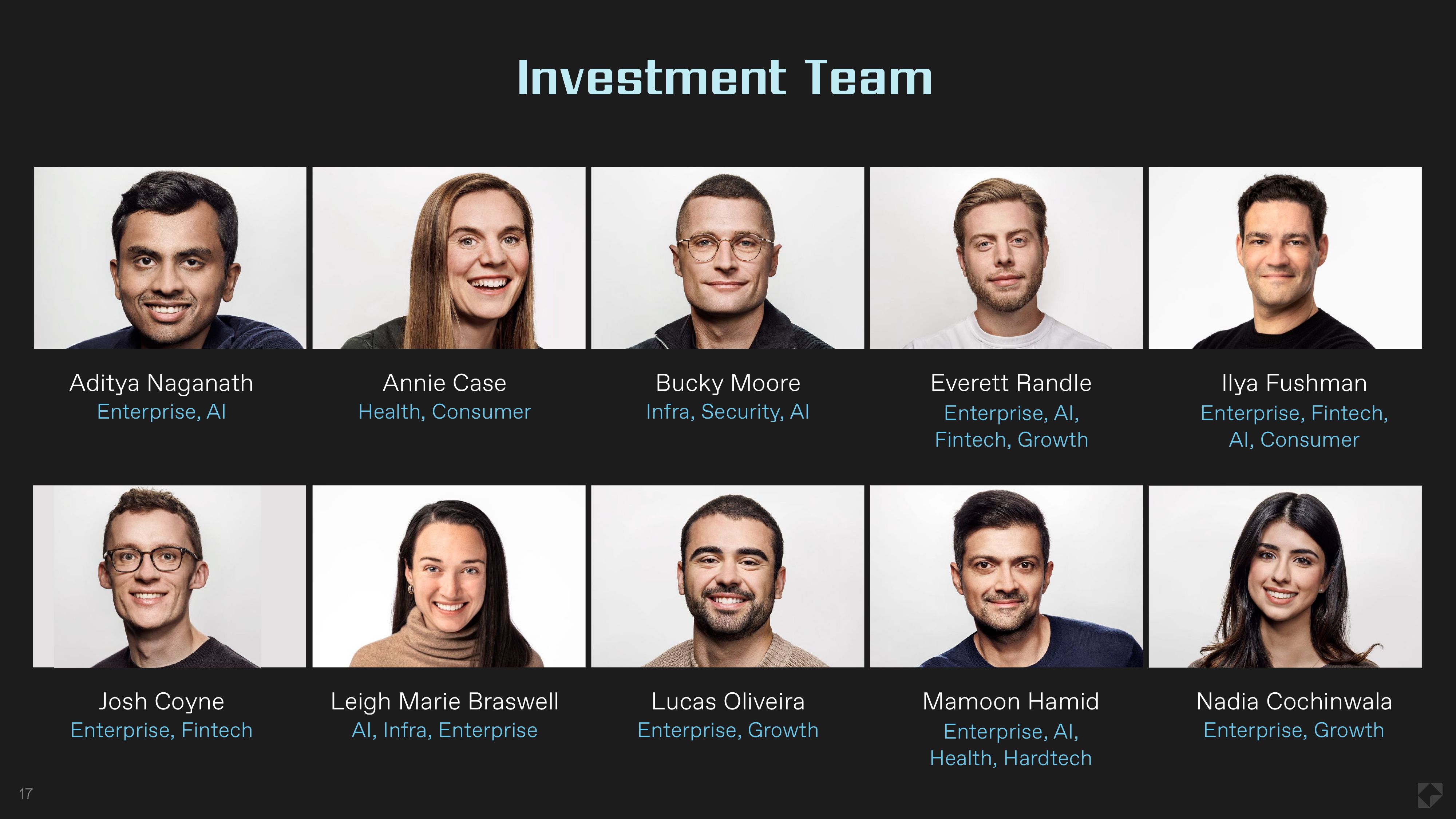

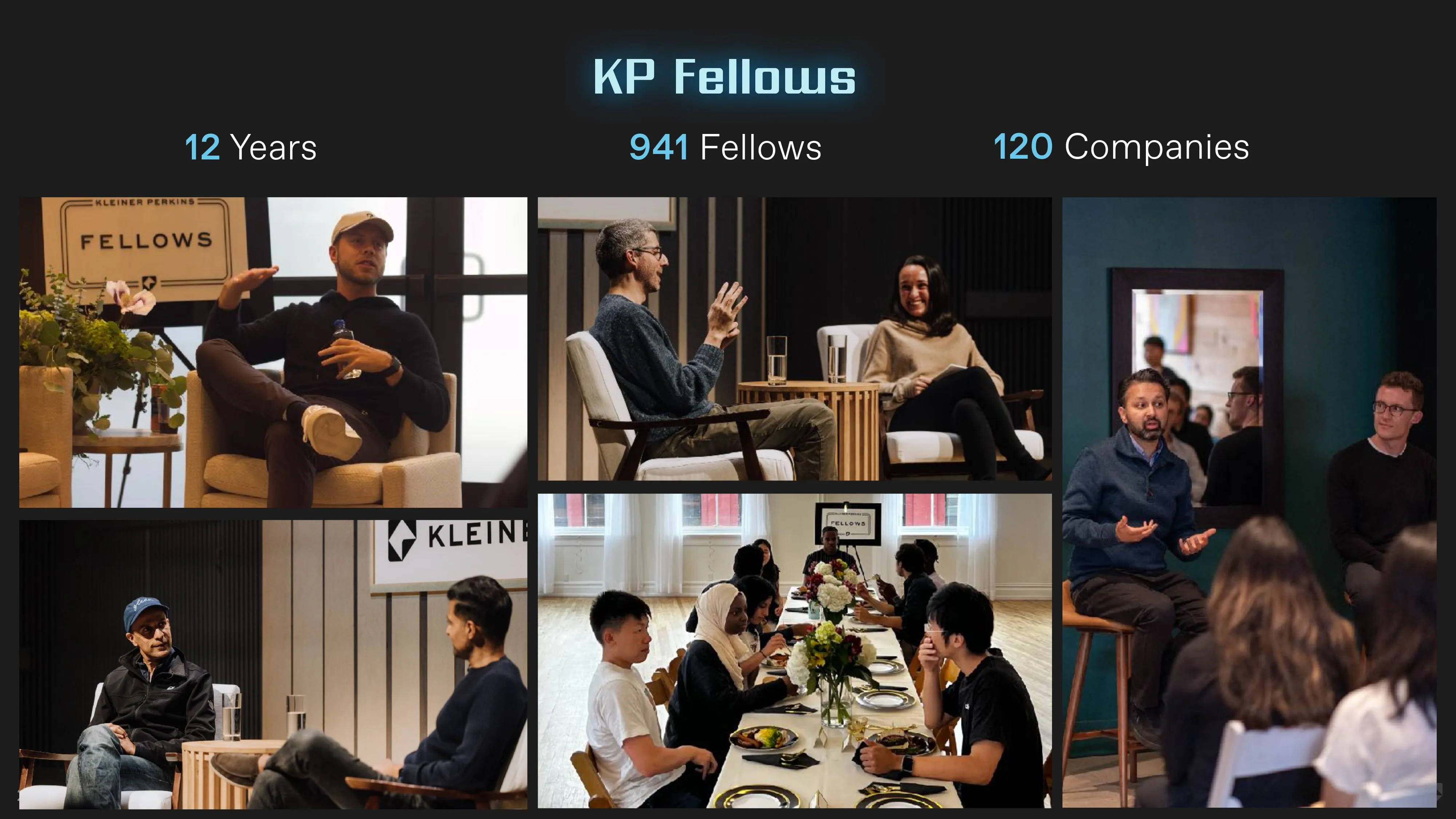

While technology and our industry are changing dramatically, the fundamentals of our approach to venture capital remain the same – venture is an art and a craft that’s grounded in a deep connection with entrepreneurs and all-out effort to help them build history making companies. Since 2022, we have expanded our team to better serve entrepreneurs with the additions of Leigh Marie Braswell, our partner focused on AI, and Everett Randle, our partner leading our growth efforts.

We are deeply thankful to all the founders who have partnered with us on this journey so far, and couldn’t be more excited for the future.

– Kleiner Perkins Team