Crypto 2021: From “Alternative” to Mainstream

Almost 2 years after publishing our initial 2019 Crypto Thesis, the cryptosphere has meaningfully changed. At the time, we were hyper-focused on the foundation needed for adoption — specifically, the financial infrastructure and developer tools for the next wave of investors, users and builders.

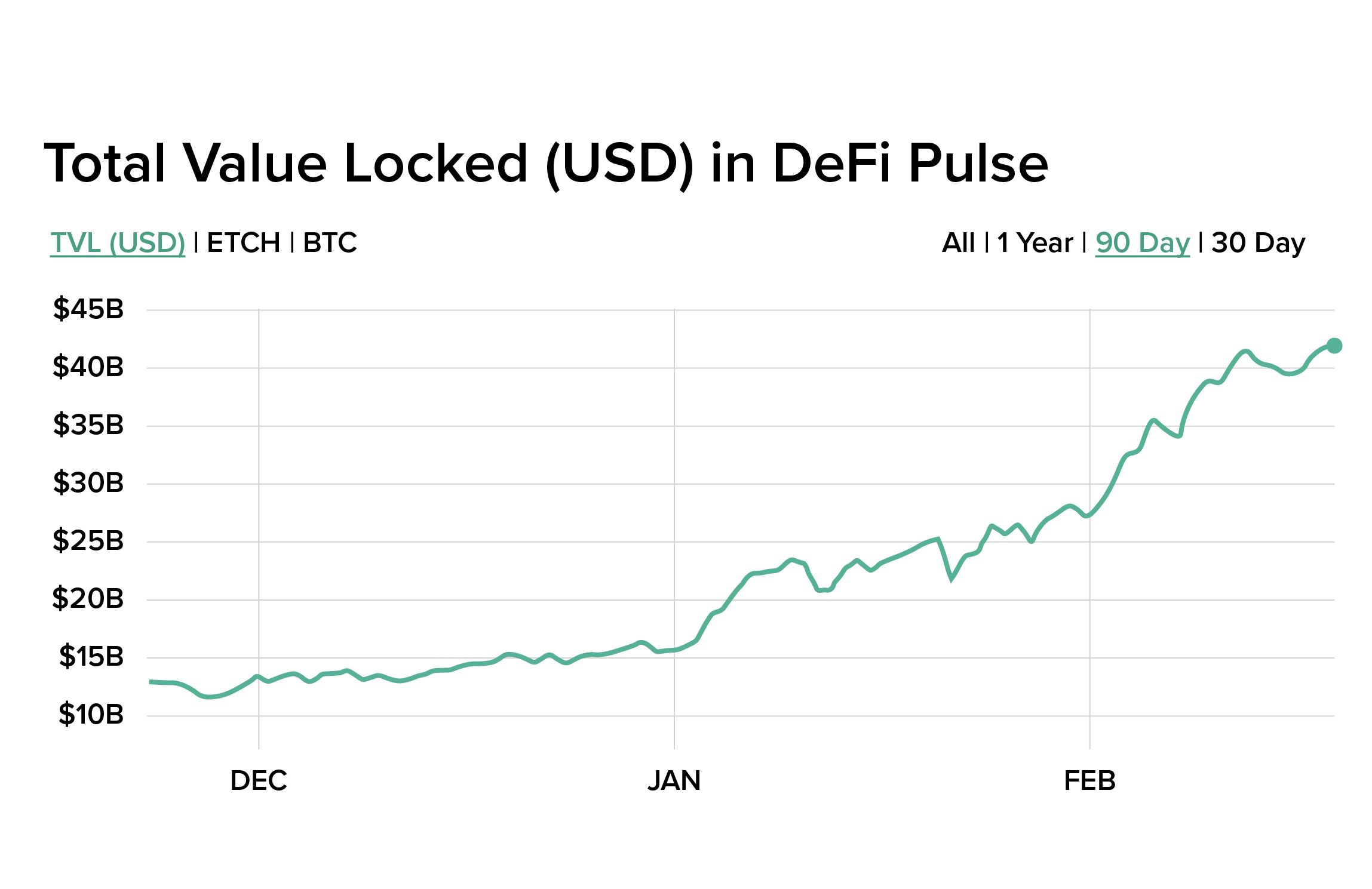

Since, we’ve invested in companies building at the bleeding edge like Bison Trails (recently acquired by Coinbase) and Skew. That infrastructure is matched by large investments from gatekeepers like Visa’s work with USDC, Fidelity and BNY Mellon’s entrance from the institutional world, Cloudflare’s efforts around Ethereum & IPFS, and increasing regulatory clarity. Along the way, DeFi skyrocketed to total locked value >$40B and NFTs piqued the interest of the crypto-curious like celebrities and sports fans.

These developments come as the world is grappling with questions around censorship and decentralization, and as consumption online and in virtual worlds is hitting all-time highs. Such trends suggest we are poised for an explosive next chapter of crypto, with massive opportunities around:

- Passion Investing & Dynamic Creativity: NFTs with powerful, programmable ownership benefits and potential social extensions.

- Decentralized Access & Ownership: Builders and investors everywhere will have access to more opportunity ー streaming payments for development and consumption, DeFi as a means to a universal savings rate and cross-border, cross-stage investments.

- Institutional & P2P Financial Rails: The next wave is institutional, including stablecoins and CBDCs as the backbone for improved B2B payments and P2P remittances, payments and savings products.

Passion Investing & Dynamic Creativity

Millennials and GenZ are building wealth in the wake of the Great Recession and a near-zero interest rate environment. They’re redefining the old 60/40 rule, viewing investing as more than just a retirement plan. Instead, investing is personal; it’s social and happens in communities; it’s a hobby and a way to express your identity. This is passion investing, and it includes everything from cryptocurrencies to fashion and sneaker drops, to collectibles like wine and cards, to in-game dance moves.

NFTs are a natural evolution of passion investing. When we wrote about NFTs two years ago, the novelty was around scarcity and permanence ー the magic that these items are universally yours, rather than existing solely in a virtual world or any specific ecosystem. NFTs like Cryptokitties were still “toys” because the ecosystem around Ethereum was too nascent to support such adoption. Now, we see Layer2 and scaling solutions on the horizon, more accessible entry points to mint and hold NFTs like OpenSea, Foundation and Zora, and well-known brands like the NBA Top Shot and Liverpool FC moving the space forward.

These newer projects surface the power of programmability while abstracting complexity. Today’s NFTs speak to new business and rewards models built around fan engagement “perks”: direct control, customization, and the opportunity to make money as an owner. For example, NBA Top Shot’s challenges ー from collecting a series to online community participation to an IRL event ー unlock bonus features or new packs automatically. These challenges are amazing ways to reward superfans and build an omnichannel engagement campaign. NFTs offer a chance for fractional and interactive ownership ー for example, you could change the ending of a story or the mood of a painting as seen on Async Art. That also introduces inherent dynamism, as features could be adapted based on external elements like time, weather, winners of sporting events, stock prices. These NFTs could even programmatically generate interest while you hold them. For online brands, website art could be transformed into an interactive experience with your users.

Such functionality may feel like silly or toy-like now, but we believe passion investing and dynamic art is just getting started in the world of NFTs. We’re excited to chat with folks fostering creative communities, social experiences and marketplaces for more creation, discovery and showcasing of those NFTs.

Decentralized Access & Ownership

Crypto combines two movements under the umbrella of decentralization: a distributed, global market that strives for equal access therein + a belief in censorship-resistance and distrust in institutions.

Those movements firmly collided over the past year. Covid-19 pushed many people to retreat to home states or countries, and left us all to communicate predominantly online. That level playing field brought opportunity: remote work is a new norm, entrepreneurs are raising money from their bedrooms all over the world, and online communities seem richer than ever. At the same time, censorship has hit the mainstream zeitgeist around the world, from social media migrations to a retail stock market backlash. Long-discussed tensions with gatekeepers like Apple are starting to boil over.

These fractures are symbols of the growing skepticism of overextended, centralized solutions. While the cracks in belief grow meaningfully every year, crypto is forging useful alternatives in tandem. We see renewed opportunity for startups to enable decentralized collaboration and community building, to counter growing concerns of censorship and central control. To foster that, we’re curious to see user and developer platforms that leverage novel incentive structures or incorporate streaming micropayments for developer & content contributions or consumption in real time.

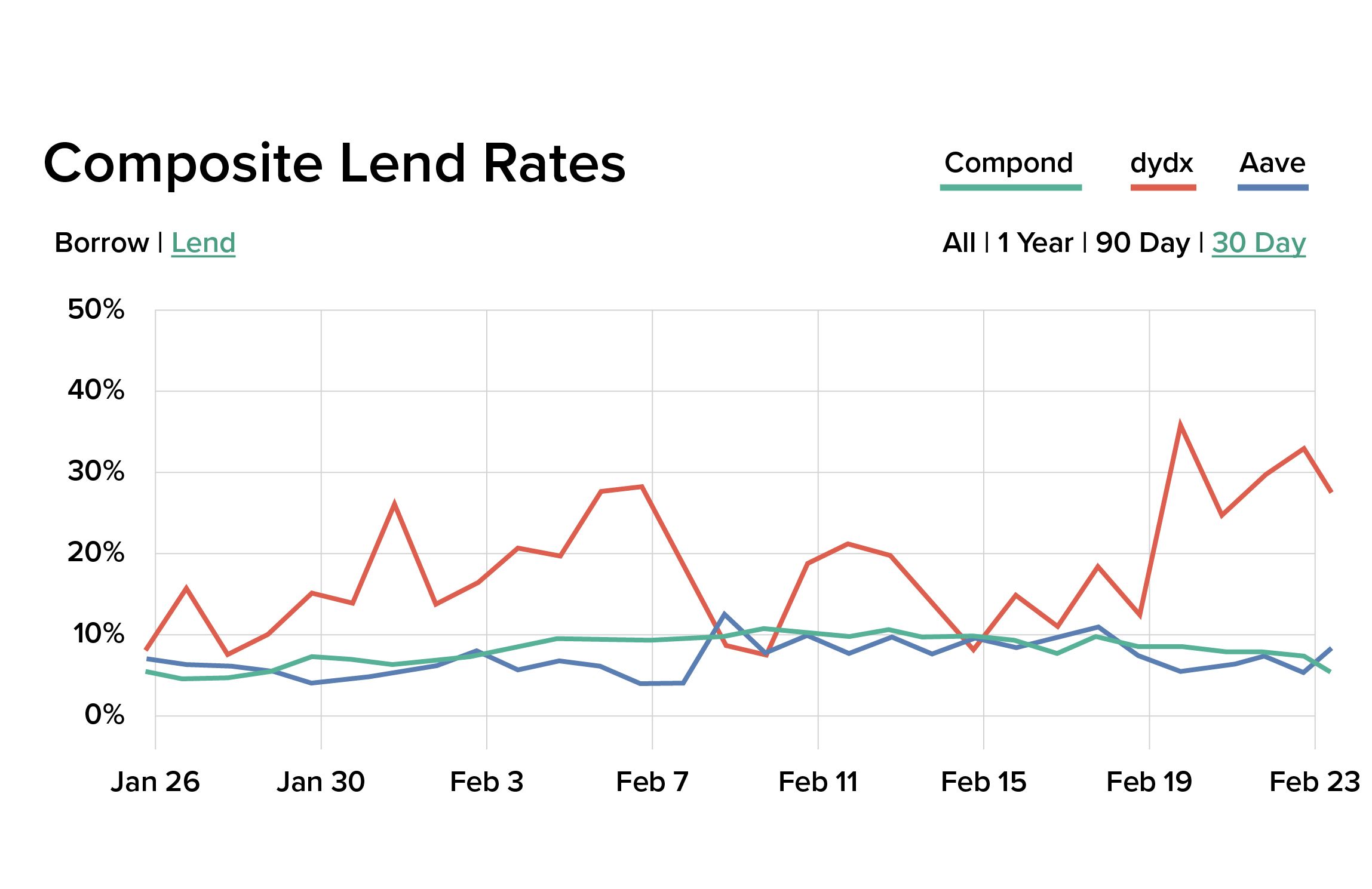

Along the lines of economic inclusion and access, Decentralized Finance (DeFi) holds much promise. As new players like Argent and Donut work to abstract away the complexity, users will find a very simple, clear value prop of DeFi: high-yield! In today’s terminally low rate environment, stablecoin yields should be a compelling building block for all financial services companies. DeFi Is essentially creating a universal interest rate. We are eager to see how startups will bridge DeFi into traditional financial offerings – i.e. a user-friendly, best in class high-yield savings option.

Additionally, many yield farms or DeFi opportunities are a chance to invest in and earn a piece of a new protocol or project early — almost akin to early stage venture investing. While that holds risk of its own, new companies and protocols like UMA will help consumers take advantage of such cross-border, cross-stage access to emerging products and existing assets like foreign stocks.

Institutional & P2P Financial Rails

There are clear proof points that institutional money is in the market for crypto. That traverses corporates (Microstrategy, Tesla, Square), institutional investors and sovereigns.

"Square believes that cryptocurrency is an instrument of economic empowerment and provides a way for the world to participate in a global monetary system, which aligns with the company’s purpose," ー Square’s statement on buying $BTC

"Bitcoin is a bank in cyberspace, run by incorruptible software, offering a global, affordable, simple, & secure savings account to billions of people that don’t have the option or desire to run their own hedge fund." ー Michael J. Saylor, MicroStrategy

“We do have a problem with financial inclusion. Too many Americans really don’t have access to easy payment systems and to banking accounts, and I think this is something that a digital dollar — a central bank digital currency — could help with." ー Treasury Secretary Janet Yellen

Large investors will increasingly require institutional grade crypto investment products over the coming years that extend liquidity, including foundational blocks like a connective settlement layer across venues and exchanges, equal access across FX pairs and corporate trust structures. Such critical infrastructure has inherent network effects and benefits early movers like Fireblocks and Talos.

Institutional money may be just the beginning, though. The larger opportunity seems to lay ahead in stablecoins and Central Bank Digital Currencies (CBDC). Stablecoins have broken through $40B in market cap, with Visa announcing support for stablecoins as a solution for next-gen B2B payments. Per that, we’re excited to invest in companies fostering stablecoin-based B2B payments, including treasury management and integrations into traditional corporate interfaces. On the CBDC front, China is expected to be first to market, mounting pressure on other central banks to embrace blockchain technology.

Both stablecoins and CBDC represent an improvement over the status quo in speed and cost, but they also bring large unknowns around regulations and privacy standards. That said, it’s undeniable that these two movements from both public and private players represent a new era of payment rails. We expect to see new players emerge on the P2P side for remittance, payments, and savings products with stablecoins/CBDCs as the backbone.

This wave of adoption and attention is the start of a shift in crypto from an “alternative” asset and mindset to the mainstream. From NFT discovery and displays, to a DeFi based savings account, to stablecoin/CBDC-based payments, there is ample opportunity for the next generation of defining companies.

If you’re building in any of these spaces, we’d love to hear from you! Please reach out to me, at [email protected].

ー Monica