Welcome Pillar

The student loan debt crisis reached an all-time high in 2019 and has grown into a colossal challenge for many Americans. In fact, student loans have become the second largest consumer debt class today, with 45 million borrowers in the United States owing more than $1.5 trillion. Over 20 percent of student borrowers will owe more than $100,000 after graduation, which will take years to pay off. The influx of student loan debt has also compounded the massive disparity in economic and wealth creation opportunities in America. Research from the National Association of Realtors shows that 83% of people ages 22 to 35 blame student loans as the reason for not purchasing a home. Women, who owe two-thirds of all student loan debt, are disproportionately impacted due to the gender pay gap and average two extra years for repayment. This is a massive challenge for our society and economy – and it’s getting worse, fast.

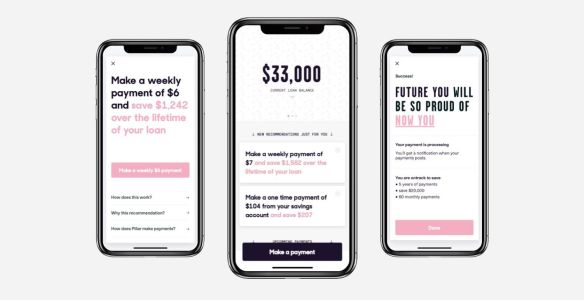

Today we’re thrilled to announce our investment in Pillar. Founded in 2018 by Michael Bloch and Gilad Kahala in NYC, Pillar is making it radically easier for graduates to manage student debt and achieve financial well-being through its fully-automated loan payment platform. The idea for the company was conceived from Michael’s first-hand experience when he and his wife were navigating the complexities of the repayment process for their own student loans (which amounted to over $300,000). As they struggled with outdated providers and decades-old software that made refinancing and pre-payment strategies impossible, Michael knew he had to drop out of Stanford’s GSB to build a better solution.

With Pillar, users securely connect their bank accounts to the platform via a mobile application to receive customized recommendations for managing their debt. Pillar’s technology also allows users to see how much money they’ll save through specified payments and if they can afford to increase or decrease their payments over time. Borrowers can make in-app payments and are regularly updated with new tips to help pay off loans more efficiently. Today, Pillar links more than $50 million worth of student loans onto the platform and has helped the average borrower save nearly $6,200 and four years on repayment. With Pillar, not only are customers saving time and money, but people are more empowered to take control of their financial future.

We’re looking forward to partnering with Michael, Gilad, and the Pillar team as they continue tackling a fundamentally broken student loan industry while making it easier for people to get out of debt faster and focus on what matters most to them – those big moments like starting a family, investing in a small business, or purchasing a new home.

- Monica and Ilya